6 Money Rules Every Woman Needs to Know

Personal finance expert Farnoosh Torabi lays out the ground rules for saving money, building a retirement fund and improving your relationships.

Photo: Nuthawut Somsuk/Getty Images

I first began earning money at age 5. My parents and I had gone to the Worcester Center mall in Massachusetts, and I was sulking because my mother had refused to buy me a toy. I don't recall what I wanted—maybe a Cabbage Patch Kid, maybe a Strawberry Shortcake doll—but I vividly remember the desperate feeling when I heard that no. Even at 5, I knew that having your own money meant freedom, choices, and not needing to beg. At that moment, my parents had the money, and I had nothing. Cue sad-face emoji.

My uncle Ali, who'd joined us that afternoon, asked about my frown. He says I told him, "If I had my own money, then I could buy whatever I want." He encouraged me to ask my parents for an allowance, some pocket money in exchange for helping around the house and staying out of trouble. Work would allow me to earn, and earning would give me some independence. I was all in.

I suggested $2 a week, but my uncle said, "No. Ask for $4." Whether it was pressure from him or my hopeful brown eyes (or both), my parents agreed to that sum.

That taste of financial freedom made me crave more: As I grew older, my allowance increased. At 15, I applied for my first real job, as a restaurant hostess. In college, I had three internships, waited tables, earned commissions for selling advertising for the school paper, and even did a stint in telemarketing. After that, I became a journalist but always found extra revenue streams to help pay for rent, student loans, and the occasional dinner out with friends. And I was never hesitant to ask for a raise. (Thanks, Uncle Ali!)

Of course, not all my financial stories are positive. In college, I racked up an embarrassing number of overdraft fees before I learned how to properly use a debit card. Later, living in New York City in my 20s, I faced $30,000 in student loan and credit card debt while making $18 an hour—before taxes. But I never forgot the money fundamentals I'd learned as a kid. Now, as a married woman with a young son, I'm on solid footing. I know being financially responsible gives our family flexibility, the opportunity to pursue goals, and a better night's sleep. That's what my uncle taught me all those years ago: to care about my financial well-being and think of money as a vehicle to get what I want out of life. The lesson was priceless.

Reflecting on our financial past gives us context for the way we think about and use our cash today. Our memories may leave us feeling that money is abundant or scarce. They may bring us confidence or insecurity, optimism or pessimism. But here's the beauty of these stories: You can leave them behind. If your history with money isn't the best, you can steer toward something better. And as you forge your own path, remember these six financial principles:

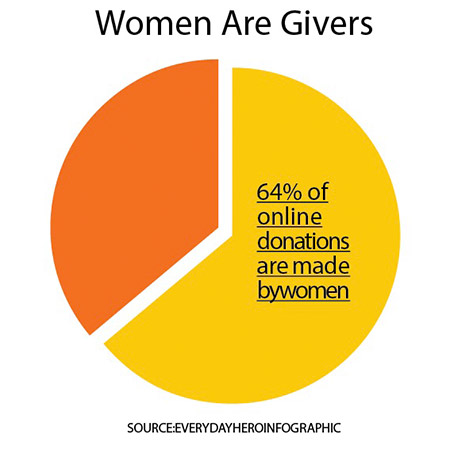

1. Wealthy women can transform the world.

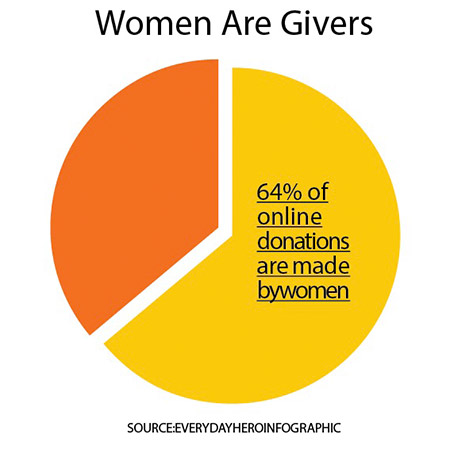

One great thing about increasing your income is that it lets you give: Research shows that at virtually all income levels, female-headed households (with women who are single, divorced, or widowed) donate more money to charity than male-headed ones. So we need additional top-earning women to spread the wealth and make the world a better place.

Illustration: O, the Oprah Magazine

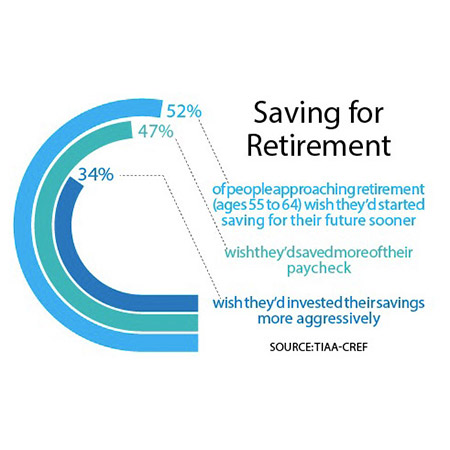

2. Planning today avoids headaches tomorrow.

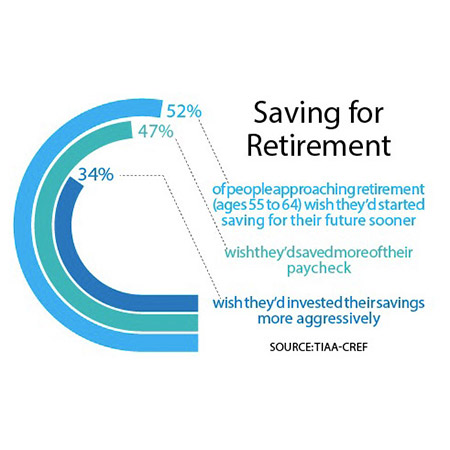

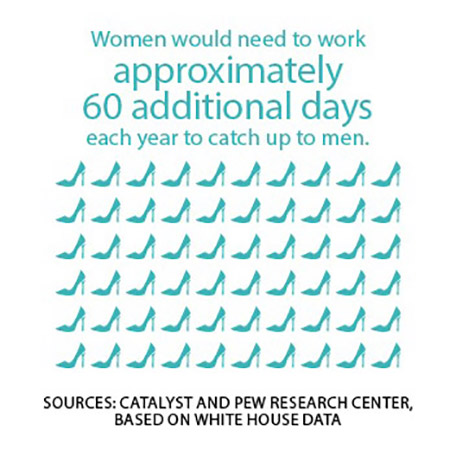

Women typically live longer than men and pay more for health care over our lifetime, so we should make saving a top priority. It's a challenge, of course, because we earn less in our lifetime. But your future is worth the effort. Contribute the maximum in your employee retirement account, or start an individual retirement account. Something I like to remember: You don't have to be wealthy to invest, but you have to invest to be wealthy.

Illustration: O, the Oprah Magazine

3. Your money needs meaning.

Without goals, your money is worthless. If you're not sure how to manage your income or prioritize your spending, take a step back from the numbers and imagine where you'd like to be in the next few years. What goals would you like to accomplish—both personally and professionally? Maybe you want to buy a new home or switch careers. Most goals carry a price tag, and the sooner you identify them, the more motivated you'll be to save.

Illustration: O, the Oprah Magazine

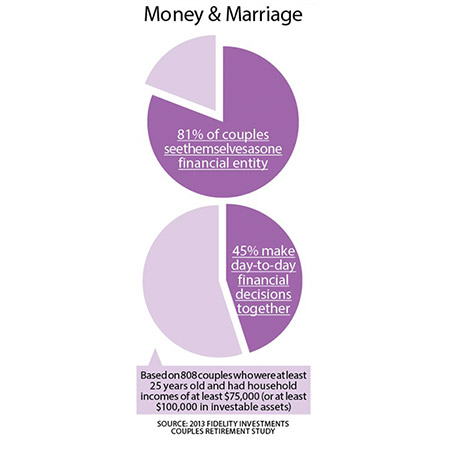

4. Partners who save together stay together.

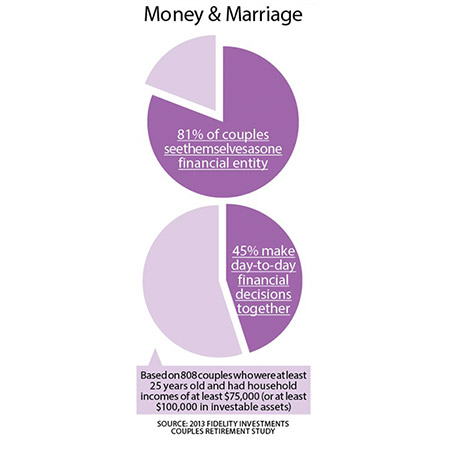

I've dedicated a large part of my career to helping couples sort out their financial differences. And I've grappled with those issues in my own life: I outearn my husband, which isn't the norm and has created unique emotional challenges in our relationship. But with mutual respect and frequent communication—like monthly check-ins—you'll have a good chance of achieving harmony.

Illustration: O, the Oprah Magazine

5. You don't ask, you don't get.

As I've learned, you don't get what you deserve in life; you get what you negotiate. And who doesn't like a sweet deal? Whether you're going for a raise, a lower price on a new car, or a bargain on a pair of designer boots, you must ask for it. (And yes, some stores are totally up for haggling.) The more you negotiate, the more skilled you'll get, and the easier it'll become.

6. A little guidance goes a long way.

You can't make money decisions in a vacuum, and you shouldn't have to try. There have never been more free services, websites, podcasts, and other resources at your fingertips. (NerdWallet.com offers tons of info; you can even submit a question to a financial adviser and get a free response in a day or two.) So don't go it alone—reach out for professional help, like an accountant or a certified financial planner, when you need it. Your wallet will thank you.

Farnoosh Torabi, author of When She Makes More, is the host of CNBC's Follow the Leader and the award-winning podcast So Money.

My uncle Ali, who'd joined us that afternoon, asked about my frown. He says I told him, "If I had my own money, then I could buy whatever I want." He encouraged me to ask my parents for an allowance, some pocket money in exchange for helping around the house and staying out of trouble. Work would allow me to earn, and earning would give me some independence. I was all in.

I suggested $2 a week, but my uncle said, "No. Ask for $4." Whether it was pressure from him or my hopeful brown eyes (or both), my parents agreed to that sum.

That taste of financial freedom made me crave more: As I grew older, my allowance increased. At 15, I applied for my first real job, as a restaurant hostess. In college, I had three internships, waited tables, earned commissions for selling advertising for the school paper, and even did a stint in telemarketing. After that, I became a journalist but always found extra revenue streams to help pay for rent, student loans, and the occasional dinner out with friends. And I was never hesitant to ask for a raise. (Thanks, Uncle Ali!)

Of course, not all my financial stories are positive. In college, I racked up an embarrassing number of overdraft fees before I learned how to properly use a debit card. Later, living in New York City in my 20s, I faced $30,000 in student loan and credit card debt while making $18 an hour—before taxes. But I never forgot the money fundamentals I'd learned as a kid. Now, as a married woman with a young son, I'm on solid footing. I know being financially responsible gives our family flexibility, the opportunity to pursue goals, and a better night's sleep. That's what my uncle taught me all those years ago: to care about my financial well-being and think of money as a vehicle to get what I want out of life. The lesson was priceless.

Reflecting on our financial past gives us context for the way we think about and use our cash today. Our memories may leave us feeling that money is abundant or scarce. They may bring us confidence or insecurity, optimism or pessimism. But here's the beauty of these stories: You can leave them behind. If your history with money isn't the best, you can steer toward something better. And as you forge your own path, remember these six financial principles:

1. Wealthy women can transform the world.

One great thing about increasing your income is that it lets you give: Research shows that at virtually all income levels, female-headed households (with women who are single, divorced, or widowed) donate more money to charity than male-headed ones. So we need additional top-earning women to spread the wealth and make the world a better place.

Illustration: O, the Oprah Magazine

2. Planning today avoids headaches tomorrow.

Women typically live longer than men and pay more for health care over our lifetime, so we should make saving a top priority. It's a challenge, of course, because we earn less in our lifetime. But your future is worth the effort. Contribute the maximum in your employee retirement account, or start an individual retirement account. Something I like to remember: You don't have to be wealthy to invest, but you have to invest to be wealthy.

Illustration: O, the Oprah Magazine

3. Your money needs meaning.

Without goals, your money is worthless. If you're not sure how to manage your income or prioritize your spending, take a step back from the numbers and imagine where you'd like to be in the next few years. What goals would you like to accomplish—both personally and professionally? Maybe you want to buy a new home or switch careers. Most goals carry a price tag, and the sooner you identify them, the more motivated you'll be to save.

Illustration: O, the Oprah Magazine

4. Partners who save together stay together.

I've dedicated a large part of my career to helping couples sort out their financial differences. And I've grappled with those issues in my own life: I outearn my husband, which isn't the norm and has created unique emotional challenges in our relationship. But with mutual respect and frequent communication—like monthly check-ins—you'll have a good chance of achieving harmony.

Illustration: O, the Oprah Magazine

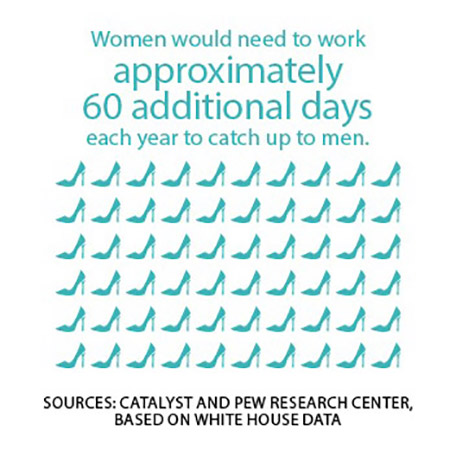

5. You don't ask, you don't get.

As I've learned, you don't get what you deserve in life; you get what you negotiate. And who doesn't like a sweet deal? Whether you're going for a raise, a lower price on a new car, or a bargain on a pair of designer boots, you must ask for it. (And yes, some stores are totally up for haggling.) The more you negotiate, the more skilled you'll get, and the easier it'll become.

6. A little guidance goes a long way.

You can't make money decisions in a vacuum, and you shouldn't have to try. There have never been more free services, websites, podcasts, and other resources at your fingertips. (NerdWallet.com offers tons of info; you can even submit a question to a financial adviser and get a free response in a day or two.) So don't go it alone—reach out for professional help, like an accountant or a certified financial planner, when you need it. Your wallet will thank you.

Farnoosh Torabi, author of When She Makes More, is the host of CNBC's Follow the Leader and the award-winning podcast So Money.