Show Suze the Money!

By Suze Orman

People across the country are counting their pennies more closely than ever and asking themselves some tough questions about what they can really afford. Suze Orman is back to approve or deny what your finances can handle—and this time around, she's settling a few family feuds.

Many women have husbands with expensive hobbies, and Michaela is one of them. Michaela has her own Mary Kay business and just started her own cake decorating business. Her husband Chris works in sales and is the ultimate Washington Redskins fan. "When I met him, I knew he was a Redskins fan. I just really had no clue he was a Redskins fanatic," she says.

Michaela estimates her husband has spent about $25,000 on his "man cave"—including a $2,200 television, a $900 surround-sound system, custom-framed photos worth about $300 and a poker table worth $500 to $1,000.

Chris spares no expense to get Redskins gear for their three kids, Michaela says—including jerseys and a Power Wheels Escalade in the Redskins' burgundy color. "I happen to know my husband's e-mail password, and there are 320 e-mails of tracking purchases," she says. "I would say that [delivery services are] at our house almost every day."

Michaela says Chris didn't grow up with much and now wants to enjoy some of his success. But Chris and Michaela aren't debt-free. Together, they owe $130,000 in student loans. "It often makes me wonder if we will ever get them paid off. If we'll ever get to the point where we can start thinking about our kids' college and the future so they don't have the loans that we have," she says.

So Michaela has a question for Suze: "With all of our student loans and his fabulous hobby, can we afford his hobby or should we be putting the money somewhere else?"

Many women have husbands with expensive hobbies, and Michaela is one of them. Michaela has her own Mary Kay business and just started her own cake decorating business. Her husband Chris works in sales and is the ultimate Washington Redskins fan. "When I met him, I knew he was a Redskins fan. I just really had no clue he was a Redskins fanatic," she says.

Michaela estimates her husband has spent about $25,000 on his "man cave"—including a $2,200 television, a $900 surround-sound system, custom-framed photos worth about $300 and a poker table worth $500 to $1,000.

Chris spares no expense to get Redskins gear for their three kids, Michaela says—including jerseys and a Power Wheels Escalade in the Redskins' burgundy color. "I happen to know my husband's e-mail password, and there are 320 e-mails of tracking purchases," she says. "I would say that [delivery services are] at our house almost every day."

Michaela says Chris didn't grow up with much and now wants to enjoy some of his success. But Chris and Michaela aren't debt-free. Together, they owe $130,000 in student loans. "It often makes me wonder if we will ever get them paid off. If we'll ever get to the point where we can start thinking about our kids' college and the future so they don't have the loans that we have," she says.

So Michaela has a question for Suze: "With all of our student loans and his fabulous hobby, can we afford his hobby or should we be putting the money somewhere else?"

Chris estimates that he spends about $7,000 a year on his hobby. Can he keep it up? Suze runs the numbers.

Chris and Michaela's monthly income is $9,000, and their monthly expenses are $7,700. Even with $1,300 leftover every month, they still face their large student debts and only have $5,000 in an emergency fund. "In this economy, what I'd like to see is that people have at least an eight-month emergency fund, which would be $40,000 because we have three children here," Suze says.

Suze denies Chris—but with love. "We only have $5,000 of an emergency fund," she says.

Chris and Michaela have life insurance, but Suze says it's simply not enough. Chris is insured for $350,000, and Michaela is insured for $200,000. The couple still owes $290,000 on their mortgage, which is $2,200 each month. If Chris dies, his life insurance policy will only cover the mortgage—and still leaves the Michaela with $4,000 a month in expenses.

"What is the rule of thumb? You plan for the worst and you hope for the best," Suze says. "But [Chris is] in sales. Anybody in sales, anything can happen at any time. So I love that you love football ... But you cannot afford it, sir."

Chris takes everything in stride. He says he's already started to look into better life insurance policies and wants to start college savings funds for his kids. "My friend, he gets it!" Suze says.

Chris and Michaela's monthly income is $9,000, and their monthly expenses are $7,700. Even with $1,300 leftover every month, they still face their large student debts and only have $5,000 in an emergency fund. "In this economy, what I'd like to see is that people have at least an eight-month emergency fund, which would be $40,000 because we have three children here," Suze says.

Suze denies Chris—but with love. "We only have $5,000 of an emergency fund," she says.

Chris and Michaela have life insurance, but Suze says it's simply not enough. Chris is insured for $350,000, and Michaela is insured for $200,000. The couple still owes $290,000 on their mortgage, which is $2,200 each month. If Chris dies, his life insurance policy will only cover the mortgage—and still leaves the Michaela with $4,000 a month in expenses.

"What is the rule of thumb? You plan for the worst and you hope for the best," Suze says. "But [Chris is] in sales. Anybody in sales, anything can happen at any time. So I love that you love football ... But you cannot afford it, sir."

Chris takes everything in stride. He says he's already started to look into better life insurance policies and wants to start college savings funds for his kids. "My friend, he gets it!" Suze says.

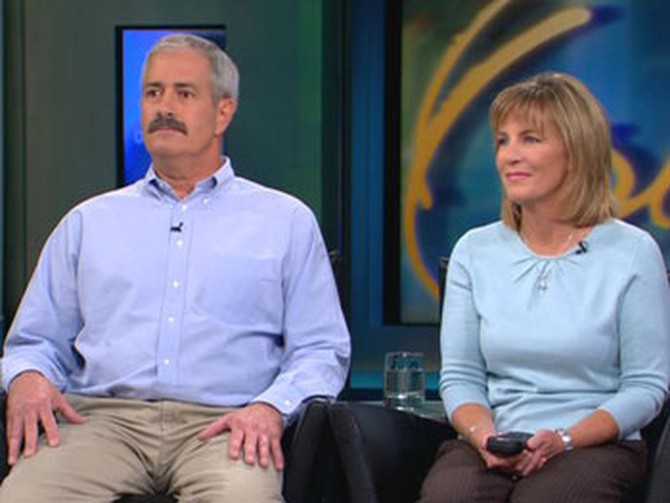

Ken and Deb are a couple facing a heart-wrenching life decision in the middle of a poor economy—divorce. Married for 12 years, the couple has a 9-year-old son and twin 7-year-old girls, one with Down's Syndrome. "Having the three children, it's been taxing on us. It just seems like we never get a chance to be alone and be together and just talk things out," Ken says. "We're just not on the same page."

Deb says she doesn't put Ken—or herself—first. "My children are first and foremost in our life, and I don't think that's a good way to build a marriage or a life either," she says. "You kind of cast the other person aside."

Ken and Deb signed separation papers in April 2008 but still live together in the house they purchased 10 years ago. "Ken and I have been living in separate rooms since last November. He lives down the hall in what used to be our home office, and it's very difficult living under the same roof," Deb says. "Unfortunately, we cannot afford to financially divorce and move on with our lives."

To complicate matters, Ken recently found out that he will be losing his job. "I think if Ken and I separated, we'd both be more relaxed and we'd be happier people," Deb says. "Obviously, we cannot afford to maintain separate households."

Deb has come to Suze for help with her question—can she afford to get divorced?

Get Suze's latest recession advice delivered to your inbox—sign up for her newsletter.

Deb says she doesn't put Ken—or herself—first. "My children are first and foremost in our life, and I don't think that's a good way to build a marriage or a life either," she says. "You kind of cast the other person aside."

Ken and Deb signed separation papers in April 2008 but still live together in the house they purchased 10 years ago. "Ken and I have been living in separate rooms since last November. He lives down the hall in what used to be our home office, and it's very difficult living under the same roof," Deb says. "Unfortunately, we cannot afford to financially divorce and move on with our lives."

To complicate matters, Ken recently found out that he will be losing his job. "I think if Ken and I separated, we'd both be more relaxed and we'd be happier people," Deb says. "Obviously, we cannot afford to maintain separate households."

Deb has come to Suze for help with her question—can she afford to get divorced?

Get Suze's latest recession advice delivered to your inbox—sign up for her newsletter.

Before Ken lost his job, the couple made a combined $4,500 a month. With only Deb's income, the household total will decrease to $1,645. Monthly expenses that will not decrease total about $4,300 each month. The couple also has $10,000 in credit card debt.

Despite their precarious financial situation, Suze approves Deb for a divorce. "In this particular situation, if they were to sell the house, there is enough equity in the house to pay off their mortgages for them to have $10,000 extra to pay off the credit card debt and for them each to have $5,000 to start over in renting an apartment," Suze says.

Suze says Deb could rent an apartment for about $800 a month. "And on everything else that I figured for her, she could live in that apartment with her children and make it for $1,645 a month, also assuming that one day Ken will have to pay child support when he does get a job," Suze says.

Despite their precarious financial situation, Suze approves Deb for a divorce. "In this particular situation, if they were to sell the house, there is enough equity in the house to pay off their mortgages for them to have $10,000 extra to pay off the credit card debt and for them each to have $5,000 to start over in renting an apartment," Suze says.

Suze says Deb could rent an apartment for about $800 a month. "And on everything else that I figured for her, she could live in that apartment with her children and make it for $1,645 a month, also assuming that one day Ken will have to pay child support when he does get a job," Suze says.

Still, Suze says the real question here isn't about the money. "Can she afford not to, emotionally speaking?" Suze says.

Because Deb says she never puts herself first, Suze wants to know how much longer Deb would stay in a marriage she says is already over. "How much longer are you going to stay in a situation that you know is absolutely over because you think you don't have the money to leave?" Suze says. "You lose your soul for money. You lose your children in terms of not understanding what's happening for money. Is money worth that?"

But Deb's not alone. Suze says the number one deficit in this country is women not taking care of themselves. "Women give of themselves. They never give to themselves. And that we have to change," Suze says.

Deb says she's willing to try Suze's recommendations. "I think we need to be separate to find out what we both need," she says.

Because Deb says she never puts herself first, Suze wants to know how much longer Deb would stay in a marriage she says is already over. "How much longer are you going to stay in a situation that you know is absolutely over because you think you don't have the money to leave?" Suze says. "You lose your soul for money. You lose your children in terms of not understanding what's happening for money. Is money worth that?"

But Deb's not alone. Suze says the number one deficit in this country is women not taking care of themselves. "Women give of themselves. They never give to themselves. And that we have to change," Suze says.

Deb says she's willing to try Suze's recommendations. "I think we need to be separate to find out what we both need," she says.

With skyrocketing tuition costs and the economy making student loans harder to get, many families fear that college could be out of reach for their children. Cathy and Jamie disagree on how to pay for their daughters' tuitions—but they're running out of time. Their oldest, Alex, will start school next fall and is considering schools that will cost $40,000 a year.

Jamie has told Alex she can go to the school of her choice and is thinking about taking out a $160,000 loan to pay for it. "I think it's our responsibility to pay for her education," he says. "I would mortgage my home seven times over to send my daughter to the college of her choice."

Cathy isn't so sure. "I don't understand paying a gazillion dollars for college when Alex doesn't even know what she wants to study and we have another daughter coming up for college in two more years," she says. "I work hard for us to live within our means so that we can retire someday, and I don't want to go into debt over this."

Now, the couple is asking Suze whether they should go into debt for their daughters' college educations.

Jamie has told Alex she can go to the school of her choice and is thinking about taking out a $160,000 loan to pay for it. "I think it's our responsibility to pay for her education," he says. "I would mortgage my home seven times over to send my daughter to the college of her choice."

Cathy isn't so sure. "I don't understand paying a gazillion dollars for college when Alex doesn't even know what she wants to study and we have another daughter coming up for college in two more years," she says. "I work hard for us to live within our means so that we can retire someday, and I don't want to go into debt over this."

Now, the couple is asking Suze whether they should go into debt for their daughters' college educations.

Suze estimates that Cathy and Jamie will eventually need to take out $320,000 for both girls, but she runs the numbers based on paying for their eldest daughter, Alex, alone.

Together, the couple's monthly take-home income is about $6,500, and they have $6,300 in monthly expenses. So far, they've saved a total of $7,500 in college funds and have another $9,000 in an emergency fund.

Jamie says he intends to borrow the money through student loans and pay it back monthly over time. To borrow $160,000 for Alex, Suze says Jamie would likely get a PLUS loan through the government. At 8.25 percent over a 30-year term, Suze calculates a repayment of $1,275 each month. The interest they would pay over 30 years on that money is a whopping $300,000!

And that's only for one child. "So not only will Daddy and Mommy having to be paying every month on one child till they are 80, very shortly, they are going to be paying $2,500 to $2,600 a month for 30 years," Suze says. "They're bringing in as much as they have going out right now."

Together, the couple's monthly take-home income is about $6,500, and they have $6,300 in monthly expenses. So far, they've saved a total of $7,500 in college funds and have another $9,000 in an emergency fund.

Jamie says he intends to borrow the money through student loans and pay it back monthly over time. To borrow $160,000 for Alex, Suze says Jamie would likely get a PLUS loan through the government. At 8.25 percent over a 30-year term, Suze calculates a repayment of $1,275 each month. The interest they would pay over 30 years on that money is a whopping $300,000!

And that's only for one child. "So not only will Daddy and Mommy having to be paying every month on one child till they are 80, very shortly, they are going to be paying $2,500 to $2,600 a month for 30 years," Suze says. "They're bringing in as much as they have going out right now."

Keep Reading

Because this decision is a family affair, Suze asks the family to take a vote. In a 3-to-1 decision, the family decides against taking out large loans.

Still determined to send his girls to school, Jamie asks, "Should I forgo my retirement savings for the next 30 years and put it into college payments?" Suze says because Jamie is 50 years-old he should not postpone his retirement savings.

"I know that you have $300,000 in a retirement account," Suze says. "But $300,000 today in a retirement account [isn't a lot] if you're not going to add any more to it and the markets continue like the markets are continuing to do."

Suze says she understands that Jamie wants to be a good father and provide an education for his daughters, but there are alternatives to colleges that cost $40,000 a year.

"Do I want you to postpone your retirement? I do not. Do I want you to take loans out that you cannot afford? I do not," Suze says. "With the utmost love and respect for all of you, knowing that there are other choices, you are, from my heart, denied."

The conversation continues after the show ends. Watch Suze's advice for the entire family!

Still determined to send his girls to school, Jamie asks, "Should I forgo my retirement savings for the next 30 years and put it into college payments?" Suze says because Jamie is 50 years-old he should not postpone his retirement savings.

"I know that you have $300,000 in a retirement account," Suze says. "But $300,000 today in a retirement account [isn't a lot] if you're not going to add any more to it and the markets continue like the markets are continuing to do."

Suze says she understands that Jamie wants to be a good father and provide an education for his daughters, but there are alternatives to colleges that cost $40,000 a year.

"Do I want you to postpone your retirement? I do not. Do I want you to take loans out that you cannot afford? I do not," Suze says. "With the utmost love and respect for all of you, knowing that there are other choices, you are, from my heart, denied."

The conversation continues after the show ends. Watch Suze's advice for the entire family!

Eric and Anastasia are a young couple ready to walk down the aisle—she wants the storybook wedding, and he wants something small that they can afford. "We want to get married," Anastasia says. "But he won't buy an engagement ring until I give him our wedding budget."

Eric, who majored in finance, doesn't want to say "I do" to a mountain of wedding debt, but Anastasia says she's willing to splurge.

"I figure we're both young, motivated people and we'll make the money back one day. A wedding only happens once in a lifetime, and I want the fantasy," Anastasia says. "So the question is, can we afford my dream wedding?"

Eric, who majored in finance, doesn't want to say "I do" to a mountain of wedding debt, but Anastasia says she's willing to splurge.

"I figure we're both young, motivated people and we'll make the money back one day. A wedding only happens once in a lifetime, and I want the fantasy," Anastasia says. "So the question is, can we afford my dream wedding?"

Although Eric wants a wedding with 100 people tops, Anastasia has 95 people in her family alone—and refuses to leave anyone out. Anastasia thinks she can pull off the big day for about $20,000, but Eric would rather spend $5,000.

Suze has a big reality check for both of them. Based on prices where they live in Orange County, California, Suze estimates that Anastasia's dream wedding will cost $50,000 and the small wedding that Eric wants would cost about $20,000.

After determining the cost of Eric and Anastasia's wedding, Suze says it's time to check out their finances to see if they really can afford it. Anastasia and Eric take home $7,800 a month and have $7,700 in monthly expenses. Together, their credit card debt totals $16,000 and they owe $29,000 in student debt. Their emergency fund is worth $18,000.

Still, something doesn't compute for Suze. Anastasia originally told Suze she had $7,800 in student loans and owed only $6,000 in credit card debt. "I also went through your credit report, and you have $12,000 of credit card debt," Suze says. She also found Anastasia really has $21,000 more in student loan debt. It was a secret Anastasia hadn't told anyone—including Eric! "He found out this morning from the producer," Anastasia says.

Anastasia's low FICO score—the three-digit credit score that everyone has—is what tipped Suze off about her hidden debt. "What you have to understand, Eric, is that when the two of you get married, and you now go to apply for a loan—let's say to buy a car or a mortgage together—your interest rate that you will be given is going to be based on your wife's FICO scores," Suze says. "The lower our FICO score, the higher your interest rate. The higher your FICO score, the lower your interest rate."

Anastasia's FICO score was in the 500 range. "In today's economy, if you don't have a FICO score of above 700, you are not going to get a loan on any level," Suze says. "So I just thought you should know I have a saying, and the saying goes like this—Before you get involved in a relationship or anything, FICO first, then sex."

Suze has a big reality check for both of them. Based on prices where they live in Orange County, California, Suze estimates that Anastasia's dream wedding will cost $50,000 and the small wedding that Eric wants would cost about $20,000.

After determining the cost of Eric and Anastasia's wedding, Suze says it's time to check out their finances to see if they really can afford it. Anastasia and Eric take home $7,800 a month and have $7,700 in monthly expenses. Together, their credit card debt totals $16,000 and they owe $29,000 in student debt. Their emergency fund is worth $18,000.

Still, something doesn't compute for Suze. Anastasia originally told Suze she had $7,800 in student loans and owed only $6,000 in credit card debt. "I also went through your credit report, and you have $12,000 of credit card debt," Suze says. She also found Anastasia really has $21,000 more in student loan debt. It was a secret Anastasia hadn't told anyone—including Eric! "He found out this morning from the producer," Anastasia says.

Anastasia's low FICO score—the three-digit credit score that everyone has—is what tipped Suze off about her hidden debt. "What you have to understand, Eric, is that when the two of you get married, and you now go to apply for a loan—let's say to buy a car or a mortgage together—your interest rate that you will be given is going to be based on your wife's FICO scores," Suze says. "The lower our FICO score, the higher your interest rate. The higher your FICO score, the lower your interest rate."

Anastasia's FICO score was in the 500 range. "In today's economy, if you don't have a FICO score of above 700, you are not going to get a loan on any level," Suze says. "So I just thought you should know I have a saying, and the saying goes like this—Before you get involved in a relationship or anything, FICO first, then sex."

So are Anastasia and Eric approved for their dream wedding? Suze says it's an easy decision. "You're denied again big-time, and the reason is this—you have nothing in savings."

Although they have money in the bank, their debt far outweighs—and cancels out—their savings. "If anything happens to either one of you, we have problems."

Still, Suze says the couple has much more to work on than just paying down debt. "You have got to tell your husband, you have got to tell your wives what you owe, you don't owe, what you have," Suze says. "You have got to be honest about your money."

"So what do we do?" Anastasia asks. "Do we elope?"

"I think you elope," Suze says. "But before you even elope and you get married, you have an honest discussion about what you have, you don't have and how Eric feels about you not telling him the truth about your financial situation."

Although they have money in the bank, their debt far outweighs—and cancels out—their savings. "If anything happens to either one of you, we have problems."

Still, Suze says the couple has much more to work on than just paying down debt. "You have got to tell your husband, you have got to tell your wives what you owe, you don't owe, what you have," Suze says. "You have got to be honest about your money."

"So what do we do?" Anastasia asks. "Do we elope?"

"I think you elope," Suze says. "But before you even elope and you get married, you have an honest discussion about what you have, you don't have and how Eric feels about you not telling him the truth about your financial situation."

Holly and her husband, David, are living in a time warp—literally. When they moved into their home in 1994, nothing had been updated since it was built in the '60s. Now, with three growing children at home, the family feels cramped—especially in the bathroom and the kitchen.

In the mornings when they are trying to get their children ready for school, the only bathroom in the house is packed. David even wakes up at 4 a.m. every morning to shower so his girls can have the bathroom later. The bathroom is also extremely outdated. "This is Formica city," Holly says. "We're looking to get rid of the blue toilet and the blue sink and make it more modern."

When people talk about homes, they often refer to the kitchen as "the heart of the home." But with linoleum flooring, golden-yellow appliances, a stove with one working burner, Formica counters and a lack of space, it's easy to see why Holly would like a heart transplant! "During the mealtime, our kitchen's so small that while I'm sitting, I can grab another fork, I can put my dish in the sink, I can throw our garbage away," Holly says. "The whole kitchen can be cleaned from the seat of my chair."

Because the bathroom and the kitchen are so outdated, Holly and David say real estate agents have told them they would not be able to sell if they wanted to. So Holly wants the remodeling to begin immediately, but David isn't sure now is the best time to start. "I think we should wait, especially the way the economy's going. We've got guys at work being laid off now," David says. "We're getting very slow. So I don't think it's a good time to do it at this point."

In the mornings when they are trying to get their children ready for school, the only bathroom in the house is packed. David even wakes up at 4 a.m. every morning to shower so his girls can have the bathroom later. The bathroom is also extremely outdated. "This is Formica city," Holly says. "We're looking to get rid of the blue toilet and the blue sink and make it more modern."

When people talk about homes, they often refer to the kitchen as "the heart of the home." But with linoleum flooring, golden-yellow appliances, a stove with one working burner, Formica counters and a lack of space, it's easy to see why Holly would like a heart transplant! "During the mealtime, our kitchen's so small that while I'm sitting, I can grab another fork, I can put my dish in the sink, I can throw our garbage away," Holly says. "The whole kitchen can be cleaned from the seat of my chair."

Because the bathroom and the kitchen are so outdated, Holly and David say real estate agents have told them they would not be able to sell if they wanted to. So Holly wants the remodeling to begin immediately, but David isn't sure now is the best time to start. "I think we should wait, especially the way the economy's going. We've got guys at work being laid off now," David says. "We're getting very slow. So I don't think it's a good time to do it at this point."

Even though they have to build a new foundation to expand the house, David thinks he can reduce the cost of the kitchen and bathroom remodel to between $80,000 and $84,000. Together, they have $5,100 a month in income, expenses of $3,600 and an emergency fund of $27,000.

Seeing that their finances are in decent shape, Suze wants to know where they are going to get the $84,000 for the remodeling. Holly explains that they already have an approved home equity line that they can borrow from.

It doesn't take Suze long to approve Holly and David's remodel—but with a small caveat. "Can you [Holly] work a little bit more to make some more money so that your husband feels a little bit more secure in doing this?" she asks.

The money lesson everyone can learn, Suze says, is to think before you spend. "If you're about to buy something and you have to put it on your credit card and all you can do is pay the minimum payment on that charge every month, I've here to tell you, you cannot afford it," Suze says.

Take control of your money with Suze's 5-Step Financial Action Plan

Get tools, calculators and workbooks from Suze Orman

Check out more of Suze Orman's money advice

Sign up for Suze's newsletter and take control of your financial future!

Seeing that their finances are in decent shape, Suze wants to know where they are going to get the $84,000 for the remodeling. Holly explains that they already have an approved home equity line that they can borrow from.

It doesn't take Suze long to approve Holly and David's remodel—but with a small caveat. "Can you [Holly] work a little bit more to make some more money so that your husband feels a little bit more secure in doing this?" she asks.

The money lesson everyone can learn, Suze says, is to think before you spend. "If you're about to buy something and you have to put it on your credit card and all you can do is pay the minimum payment on that charge every month, I've here to tell you, you cannot afford it," Suze says.

Take control of your money with Suze's 5-Step Financial Action Plan

Get tools, calculators and workbooks from Suze Orman

Check out more of Suze Orman's money advice

Sign up for Suze's newsletter and take control of your financial future!

Published 03/04/2009

Please note: This is general information and is not intended to be legal advice. You should consult with your own financial advisor before making any major financial decisions, including investments or changes to your portfolio, and a qualified legal professional before executing any legal documents or taking any legal action. Harpo Productions, Inc., OWN: Oprah Winfrey Network, Discovery Communications LLC and their affiliated companies and entities are not responsible for any losses, damages or claims that may result from your financial or legal decisions.