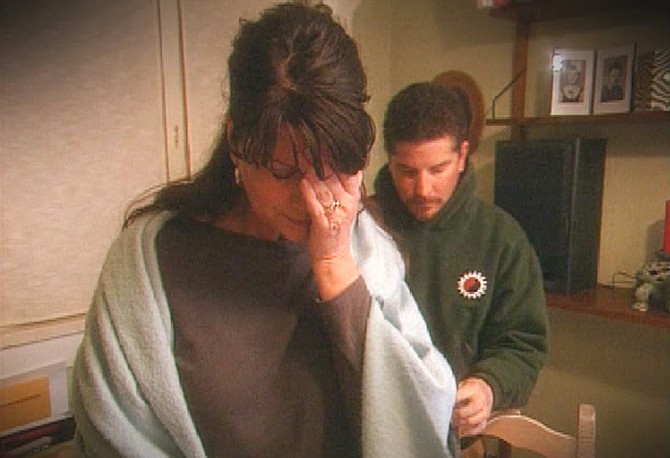

The Widlunds' Financial Struggles

Marnie and Mark Widlunds' super-sized debt has sent their lives into a tailspin, but financial expert Glinda Bridgforth has a plan. Glinda is setting up shop in the Widlunds' home! It's time for the Widlunds to roll up their sleeves and get started on the first two steps Glinda says are essential to tackling their debt.

Step One: Calculate debt and get your credit score

Glinda helps the couple look up Mark's credit score, a three-digit number that lenders use to determine credit risk. Marnie and Mark are disappointed to find out that Mark's score is 540. The median score is 700. "That means there's a lot of work for us to do," Glinda says.

Glinda also tallies up all the Widlunds' debt. With a second mortgage, Victoria's car payment and other loans, the Widlunds' total debt, including their home, is $210,000.

Step Two: Track your spending and find extra money to pay down debt

Glinda has identified four key areas where the Widlunds are wasting their money.

Late fees: $1,800 per year

Direct deposit advances: $1,440 per year

Transferring money toward Victoria's account: $2,640 per year

Food: $1,308 per month

If the Widlunds cut eating out by 25 percent and reduce other unnecessary spending, Glinda says they'll easily save more than $13,000 a year.

Step One: Calculate debt and get your credit score

Glinda helps the couple look up Mark's credit score, a three-digit number that lenders use to determine credit risk. Marnie and Mark are disappointed to find out that Mark's score is 540. The median score is 700. "That means there's a lot of work for us to do," Glinda says.

Glinda also tallies up all the Widlunds' debt. With a second mortgage, Victoria's car payment and other loans, the Widlunds' total debt, including their home, is $210,000.

Step Two: Track your spending and find extra money to pay down debt

Glinda has identified four key areas where the Widlunds are wasting their money.

Late fees: $1,800 per year

Direct deposit advances: $1,440 per year

Transferring money toward Victoria's account: $2,640 per year

Food: $1,308 per month

If the Widlunds cut eating out by 25 percent and reduce other unnecessary spending, Glinda says they'll easily save more than $13,000 a year.

Glinda says the Widlunds must go on a cash-only plan if they hope to reign in their out-of-control spending.

She establishes some tough new rules for Marnie and Mark and their daughters, 17-year-old Victoria and 15-year-old Gracie.

After Marnie and Mark destroy their debit cards, each family member receives cash for the week in an envelope. All spending must be documented on the back of the envelope.

So that Marnie and Mark can be aware of each other's purchases, Glinda takes them to the bank to set up a new banking system—now two signatures are required on every check and withdrawal. Marnie admits that the cash-only spending plan is going to be tough. "I have to keep stopping myself from thinking of ways to get around this," she says. "I am sneaky."

She establishes some tough new rules for Marnie and Mark and their daughters, 17-year-old Victoria and 15-year-old Gracie.

- Stop paying for Victoria's car.

- Stop funding Friday night dinners with friends.

- Stop incurring overdraft fees.

- Stop eating out.

- Stop giving the girls an allowance.

- Stop Marnie's shopping at the craft store.

After Marnie and Mark destroy their debit cards, each family member receives cash for the week in an envelope. All spending must be documented on the back of the envelope.

So that Marnie and Mark can be aware of each other's purchases, Glinda takes them to the bank to set up a new banking system—now two signatures are required on every check and withdrawal. Marnie admits that the cash-only spending plan is going to be tough. "I have to keep stopping myself from thinking of ways to get around this," she says. "I am sneaky."

Marnie doubted she'd be able to stick to Glinda's strict plan and she was right. Hidden cameras catch her red-handed with a secret debit card. "It's Victoria's extra debit card," she tells Mark when confronted. "I'm sorry. It's in my name, but I've never activated it!"

Mark also finds a way to cheat the system. When tracking expenses on his envelope, he lists $26.71 for gas...even though only $20 went in his car. He spent the difference on a case of beer.

After struggling initially, Mark and Marnie say they're finally learning to live with Glinda's rules—and they're reaping the benefits.

"Things are going so vastly [better]," she says. "We don't fight. ... We're to the penny that we're supposed to have in our account."

The Widlunds have adjusted their spending to allow a little give and take—for example, Mark gets a six-pack every now and then, but it's not a secret expense...he includes it in the budget.

"It feels so strange and uncomfortable to change," Marnie says, "[but] it's wonderful. Paying bills on time is phenomenal!"

Deep down, Oprah says, the Debt Diet is about more than just money—it's about eliminating emotional debt and becoming who you were meant to be.

More from Oprah's Debt Diet

"Things are going so vastly [better]," she says. "We don't fight. ... We're to the penny that we're supposed to have in our account."

The Widlunds have adjusted their spending to allow a little give and take—for example, Mark gets a six-pack every now and then, but it's not a secret expense...he includes it in the budget.

"It feels so strange and uncomfortable to change," Marnie says, "[but] it's wonderful. Paying bills on time is phenomenal!"

Deep down, Oprah says, the Debt Diet is about more than just money—it's about eliminating emotional debt and becoming who you were meant to be.

More from Oprah's Debt Diet

Published 01/01/2006

Please note: This is general information and is not intended to be legal advice. You should consult with your own financial advisor before making any major financial decisions, including investments or changes to your portfolio, and a qualified legal professional before executing any legal documents or taking any legal action. Harpo Productions, Inc., OWN: Oprah Winfrey Network, Discovery Communications LLC and their affiliated companies and entities are not responsible for any losses, damages or claims that may result from your financial or legal decisions.