Families in Crisis

Desiree and Thomas have been married for four years, have an 18-month-old daughter and are expecting twins. Desiree has brought Thomas to the show to set herself free—she's been depressed and sleepless over what she's about to reveal to her husband. She's afraid it could destroy her marriage.

Thomas believes that they're financially doing pretty well for their family, and that they're living the "American dream" with a nice house, nice cars and what he believes to be stability. He's aware they have some debt. But he thinks it's about $40,000 worth of debt—what he feels is an amount he and Desiree won't have too many problems tackling. "Financially, I think we're very stable," Thomas says. "I think we're going in the right direction. We started a good foundation for our family, and hopefully things will work out in the future."

Thomas says that Desiree keeps track of all their finances, as he believes she is better with attention to detail. Desiree, however, knows the real amount of debt they are in because of her bills and personal spending. Hear her confession.

Thomas believes that they're financially doing pretty well for their family, and that they're living the "American dream" with a nice house, nice cars and what he believes to be stability. He's aware they have some debt. But he thinks it's about $40,000 worth of debt—what he feels is an amount he and Desiree won't have too many problems tackling. "Financially, I think we're very stable," Thomas says. "I think we're going in the right direction. We started a good foundation for our family, and hopefully things will work out in the future."

Thomas says that Desiree keeps track of all their finances, as he believes she is better with attention to detail. Desiree, however, knows the real amount of debt they are in because of her bills and personal spending. Hear her confession.

Desiree says with her student loans and interest on her ever-growing credit card balances, the couple faces a whopping $160,000 in debt.

"I just want to first apologize," Desiree says. "I know you feel betrayed, and like you can't trust me. And I'm sorry. But I want you to know that telling you this will help me be the person that I need to be for you—the wife, the friend, the mother. Releasing this will help me be the person that I need to be."

"I was not aware that the debt was that enormous," Thomas says. "That's like a bowling ball being thrown at you a hundred miles an hour. … I have so many emotions. Hurt. Anger. That's a lot of money. … I have no problem taking care of my responsibility and my home financially. But to have that hanging over my head, that's a lot. And taking care of twins and a baby is no problem financially for me. But I don't even know where to begin to help."

"I just want to first apologize," Desiree says. "I know you feel betrayed, and like you can't trust me. And I'm sorry. But I want you to know that telling you this will help me be the person that I need to be for you—the wife, the friend, the mother. Releasing this will help me be the person that I need to be."

"I was not aware that the debt was that enormous," Thomas says. "That's like a bowling ball being thrown at you a hundred miles an hour. … I have so many emotions. Hurt. Anger. That's a lot of money. … I have no problem taking care of my responsibility and my home financially. But to have that hanging over my head, that's a lot. And taking care of twins and a baby is no problem financially for me. But I don't even know where to begin to help."

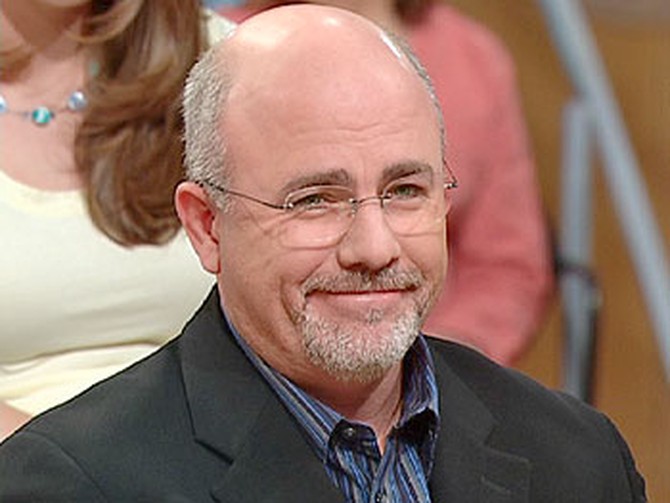

Dave Ramsey was a multi-millionaire by the time he was 26 years old, but he lost everything by age 30. Not only did Dave figure out how to erase his own debt, now the author of The Total Money Makeover teaches millions of people how they can begin to live debt-free on any salary.

Dave wanted to set the record straight for Desiree and Thomas and give them some needed hope. "I've found that when couples work together, they're able to win," Dave says. "When they try to do it separately, everything goes haywire and they run off. And it's not a corporate situation where you can just delegate. This is a relationship, and there's got to be give and take and there's got to be tons of communication."

For Desiree and Thomas, Dave says it's time to start making some sacrifices in their lifestyle. "The bad news is you've got a really big hole you're in," Dave says. "The good news is you've got a good-sized shovel. You're making over $100,000 a year, we've got $160,000 here to deal with. If we can cut back to the average family—which according to the Census Bureau is 40,000 bucks—we're about to trim your lifestyle down and get after this debt. We're going to get really serious. We've got to get on target. Stuff is no longer the target. Those babies in there, their legacy and your changing your family tree and keeping this marriage at a high quality going forward, that's the target. And so we're going to get focused, we're going to get very, very intense and we're going to walk up a series of baby steps."

Dave worked with Desiree and Thomas after the show to determine a plan to tackle their debt.

Dave wanted to set the record straight for Desiree and Thomas and give them some needed hope. "I've found that when couples work together, they're able to win," Dave says. "When they try to do it separately, everything goes haywire and they run off. And it's not a corporate situation where you can just delegate. This is a relationship, and there's got to be give and take and there's got to be tons of communication."

For Desiree and Thomas, Dave says it's time to start making some sacrifices in their lifestyle. "The bad news is you've got a really big hole you're in," Dave says. "The good news is you've got a good-sized shovel. You're making over $100,000 a year, we've got $160,000 here to deal with. If we can cut back to the average family—which according to the Census Bureau is 40,000 bucks—we're about to trim your lifestyle down and get after this debt. We're going to get really serious. We've got to get on target. Stuff is no longer the target. Those babies in there, their legacy and your changing your family tree and keeping this marriage at a high quality going forward, that's the target. And so we're going to get focused, we're going to get very, very intense and we're going to walk up a series of baby steps."

Dave worked with Desiree and Thomas after the show to determine a plan to tackle their debt.

Gamin and Billy are afraid they have raised their kids to be money monsters. They say their children, Darianne, 18, and Jesse, 16, are good students and "really good kids"—they only get in trouble with the credit card. Together, Darianne and Jesse rack up over $600 a month in charges.

The parents brown bag their lunches while their kids usually go out for lunch every day. Mom Gamin cuts coupons and buys her shoes at Payless, while her daughter buys designer clothes and wears her mother's Cartier watch. Both kids drive $25,000 cars.

Darianne and Jesse don't even help out with chores around the house. "Isn't that everybody's dream?" Darianne says, "Just to get and get and get and not really, like, work for it?"

The parents brown bag their lunches while their kids usually go out for lunch every day. Mom Gamin cuts coupons and buys her shoes at Payless, while her daughter buys designer clothes and wears her mother's Cartier watch. Both kids drive $25,000 cars.

Darianne and Jesse don't even help out with chores around the house. "Isn't that everybody's dream?" Darianne says, "Just to get and get and get and not really, like, work for it?"

Gamin doesn't want you to get the wrong idea about Darianne and Jesse. "These are amazingly good children," she insists. "They're straight-A kids, they never get in trouble, they don't do anything wrong, they're really respectful, they are really, really wonderful kids. … They're not spoiled brats."

"Then tell me this," Oprah asks Gamin. "Why did you write to us if you didn't think it was a problem?"

"Then tell me this," Oprah asks Gamin. "Why did you write to us if you didn't think it was a problem?"

"They are good kids," Dave tells Gamin. "But they are not prepared."

"I think if your kid graduates from high school and their only skill set is opening a bag of Doritos and playing Nintendo, that's child abuse."

Dave says the key to raising money-savvy kids is to make sure they make the "emotional connection" between work and money. Dave says Gamin and Billy owe their kids an apology for failing them in this way. But, Dave says, it's not too late for this family to make some changes. First, he says, Gamin and Billy should make a list of chores and put the kids on commission. Next, Dave says the kids need to learn the value of saving and giving to charity.

Finally, Dave tells Darianne to give her mom back the Cartier watch. Dave says the watch is a symbol of the new deal Gamin is making with her children. "If that watch comes off [of you and Darianne is wearing it]," Dave tells her, "you've failed the test that we put before you today."

To Bill, Dave says, "I want you to take your [business] skill set and that leadership style and want you to bring it home on this issue. I'm not saying you're a bad dad. Your kids are good kids. Now we need to make them great!"

"I think if your kid graduates from high school and their only skill set is opening a bag of Doritos and playing Nintendo, that's child abuse."

Dave says the key to raising money-savvy kids is to make sure they make the "emotional connection" between work and money. Dave says Gamin and Billy owe their kids an apology for failing them in this way. But, Dave says, it's not too late for this family to make some changes. First, he says, Gamin and Billy should make a list of chores and put the kids on commission. Next, Dave says the kids need to learn the value of saving and giving to charity.

Finally, Dave tells Darianne to give her mom back the Cartier watch. Dave says the watch is a symbol of the new deal Gamin is making with her children. "If that watch comes off [of you and Darianne is wearing it]," Dave tells her, "you've failed the test that we put before you today."

To Bill, Dave says, "I want you to take your [business] skill set and that leadership style and want you to bring it home on this issue. I'm not saying you're a bad dad. Your kids are good kids. Now we need to make them great!"

Tom and Valerie are planning a summer wedding. But behind the scenes, the happy couple is already walking down an aisle of big trouble. "Most of our wedding expenses have been put on credit cards," Valerie admits. "Even my engagement ring is on a credit card. I have spent about $15,000 on the wedding so far."

Even without their wedding expenses, Tom and Valerie's debt has spiraled out of control. Valerie holds Tom responsible for their debt because he pays the bills, but he says she is the big spender. Their combined credit card debt, student loans, car loans and personal loans totals about $200,000.

"The number one cause of divorce in North America today," Dave tells Valerie and Tom, "is money fights and money problems. You guys are going into this relationship heading into a wedding with the number one red flag waving. Don't do it!"

Dave says Tom and Valerie should definitely postpone their wedding—not until their finances are perfect, but until they have gone through pre-marital counseling and are both on the same page with shared goals, dreams and priorities.

Dave's seven steps to free your own life of financial debt!

Dave says Tom and Valerie should definitely postpone their wedding—not until their finances are perfect, but until they have gone through pre-marital counseling and are both on the same page with shared goals, dreams and priorities.

Dave's seven steps to free your own life of financial debt!

Published 09/13/2005