Why You're Losing Substantial Money at Work

If it's late fall and you have insurance through your employer, that can mean only one thing: time to review your benefits.

Photo: Sean Lee Davies

Prepare to give thanks, my friend, because that special time of year is here: open enrollment season, when employers let you make changes to your health insurance coverage. If you're thinking major snore, think again. Companies are constantly tweaking their offerings, and that affects your bottom line. Carve out some time to make sure you have the right coverage at the right price. You might reap substantial savings.

Get Flexible

If your employer offers a flexible spending account (FSA), you are crazy not to look into it. FSAs are available for healthcare expenses and dependent care. Both let you put pretax money into a separate account: Money from a health FSA can cover insurance co-pays, deductibles and medication, while a dependent-care FSA can be used for childcare (under age 13) and adult care for someone you claim as a dependent.

Give Your Health Insurance a Checkup

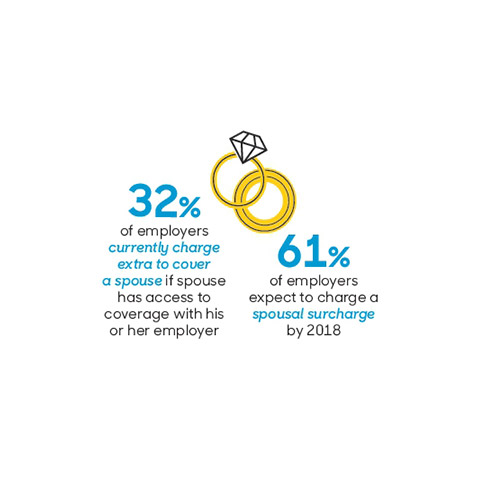

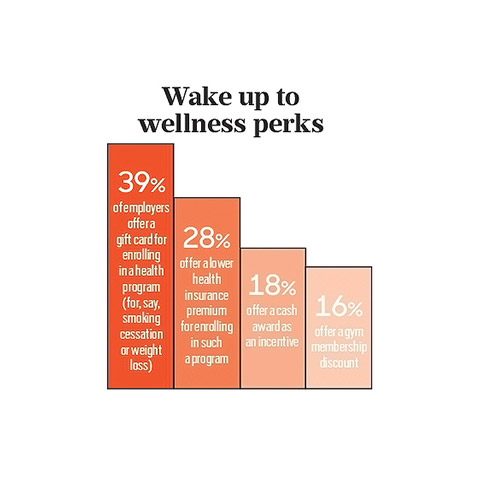

Employers today are laser focused on managing their costs, and increasingly that involves shifting more of them onto you. But you have a few money-saving moves at your disposal: