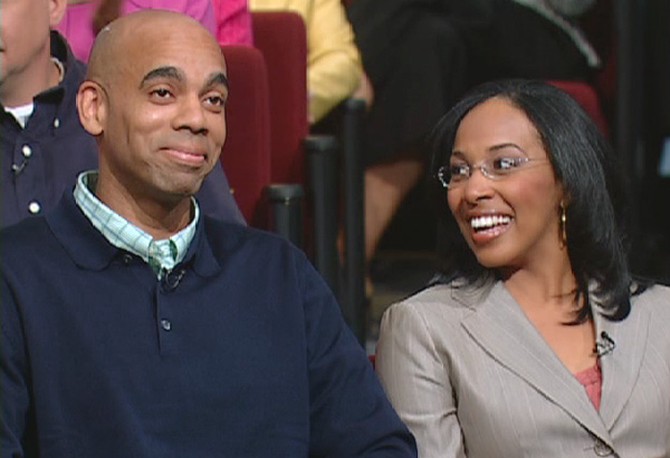

Big Steps for the Bradleys

The Bradleys have gone through the first five steps of the Debt Diet plan and are ready to tackle the next step.

Step 6: Take big steps to grow your income.

The only way Lisa and Steven are going to be able to dig themselves out of debt is by earning more money. By taking on additional jobs, the Bradleys increase their monthly income by about $3,000. Lisa is tutoring and substitute teaching, as well as increasing her hours at her current job. Steven is bringing in extra cash, too, as a DJ on the weekends and by mowing lawns.

Step 6: Take big steps to grow your income.

The only way Lisa and Steven are going to be able to dig themselves out of debt is by earning more money. By taking on additional jobs, the Bradleys increase their monthly income by about $3,000. Lisa is tutoring and substitute teaching, as well as increasing her hours at her current job. Steven is bringing in extra cash, too, as a DJ on the weekends and by mowing lawns.

An unexpected car repair threatens to set the Bradleys back thousands of dollars. The transmission on their BMW fails, depleting the value of the car to $5,000—and the Bradleys still owe $15,000 in payments.

Instead of dealing with costly repairs, the Bradleys discover they can accomplish the goals set forth in Step 6 by selling some of their assets. With the help of Crossroads Ford in Raleigh, North Carolina, LendingTree.com and RoadLoans.com, Lisa and Steven sell their BMW and SUV and purchase a new Ford Explorer—a decision that will save them $400 a month on car payments.

Lisa says she's excited about more than just the savings. "I feel like this is one of the first big decisions Steve and I have really made together and been on the same page," she says.

Instead of dealing with costly repairs, the Bradleys discover they can accomplish the goals set forth in Step 6 by selling some of their assets. With the help of Crossroads Ford in Raleigh, North Carolina, LendingTree.com and RoadLoans.com, Lisa and Steven sell their BMW and SUV and purchase a new Ford Explorer—a decision that will save them $400 a month on car payments.

Lisa says she's excited about more than just the savings. "I feel like this is one of the first big decisions Steve and I have really made together and been on the same page," she says.

On the brink of divorce just a few months ago, the Bradleys say their marriage has improved since they joined the Debt Diet. "Our communication has changed," says Lisa. "And because we're not arguing over the money anymore, we're now communicating more to each other."

Steve says he's also noticed positive changes in their relationship. "Lisa is being very considerate now," says Steve. "It's almost surprising that she's so concerned about the bills and money now. I'm in shock because she's actually doing this!"

Steve says he's also noticed positive changes in their relationship. "Lisa is being very considerate now," says Steve. "It's almost surprising that she's so concerned about the bills and money now. I'm in shock because she's actually doing this!"

Money coach Jean Chatzky says the Bradleys will be well on their way to becoming millionaires if they pay themselves first and invest half of their additional income each year. After taxes, that comes down to about $12,000 that the couple can invest. At an annual interest rate of 8 percent, in 30 years, the Bradleys will have saved $1.5 million!

Extra income = $33,000

Extra income after taxes = $24,000

Invest 1/2 annually = $12,000

30 years at 8% = $1.5 million

A stronger marriage and a bright future in savings give the Bradleys a lot to smile about. "I think we had lost each other by focusing so much on the money and the stress of the money, and it's like we've come back to each other now," says Lisa.

More from Oprah's Debt Diet

Extra income = $33,000

Extra income after taxes = $24,000

Invest 1/2 annually = $12,000

30 years at 8% = $1.5 million

A stronger marriage and a bright future in savings give the Bradleys a lot to smile about. "I think we had lost each other by focusing so much on the money and the stress of the money, and it's like we've come back to each other now," says Lisa.

More from Oprah's Debt Diet

Published 01/01/2006

Please note: This is general information and is not intended to be legal advice. You should consult with your own financial advisor before making any major financial decisions, including investments or changes to your portfolio, and a qualified legal professional before executing any legal documents or taking any legal action. Harpo Productions, Inc., OWN: Oprah Winfrey Network, Discovery Communications LLC and their affiliated companies and entities are not responsible for any losses, damages or claims that may result from your financial or legal decisions.