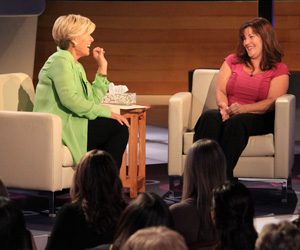

America's Money Class with Suze Orman - Financial Disasters

Any financial loss is painful. But it can also be the trigger point that helps you take control of your life and build lasting security. We must all take responsibility for the situations we find ourselves in, and at the same time, be responsible for making smart choices going forward. No matter what your financial disaster may be today, a better tomorrow depends on your willingness to take responsibility for your money. No one will ever care more about your money than you. So isn't it time to treat it with respect and confidence?

Video: Watch a real-life money scam, and how to avoid it.

To get in touch with the man that scammed Christine, please send letters to:

Roberto Heckscher # 14400-111

FCI

P.O. Box 3007

Terminal Island, Ca 90731-3007

Tools: Click here for Suze's investment calculator.

Money Lesson: Never make checks payable to anyone but a major brokerage firm or bank. Go online and check your statements directly on the firm or bank’s website. Know where your money is invested.