Family and Money

How many of you have argued with with your partner over money? No matter what the current state of the American Dream is in your family, we’ve arrived at a point in time that is defined by this one, incontestable truth: how your family spends and saves money, and how that money flows needs to be talked about. Protecting and planning for your family’s future should be a top priority in your life.

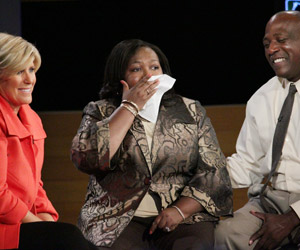

Video: Watch Suze find out who is named in Chris' will.

Tools: Click here to find out How to Make a Will

Download: Click here to Download Chris and Amy's Estate Planning Action Plan

Money Lesson: You must have an emergency fund of 8 months of expenses in savings at all times.