There's Another Gender Gap at Home No One Is Talking About

It's time to close the financial-planning gender gap.

Photo: dolgachov/iStock

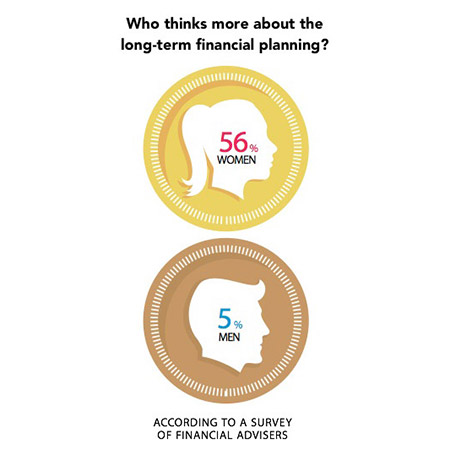

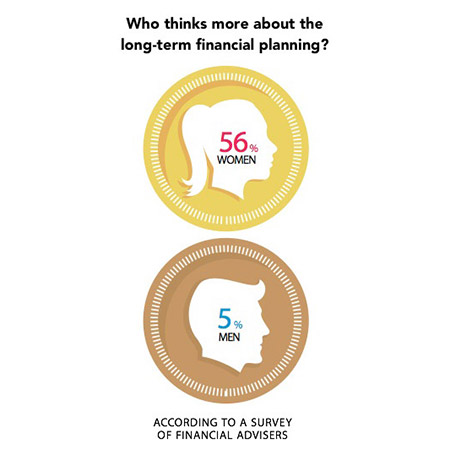

Ladies, let's woman up. I totally get that in your time-crunched life, it's smart to use a divide-and-conquer approach to household responsibilities. But when it comes to money-related tasks, the division of labor takes a troubling gender-based turn. Women usually handle the budgeting and bill paying, while men take on the long-term investing. In one recent survey of heterosexual couples, 83 percent of men reported taking the lead on investment decisions—compared with only 2 percent of women. That's not just sad, it's wrong. The purpose of money is to give you security, but you can't feel secure if you're uninformed about your investments. You are never powerful in life unless you have power over your own money. Read on and get ready to take charge....

Flying Solo

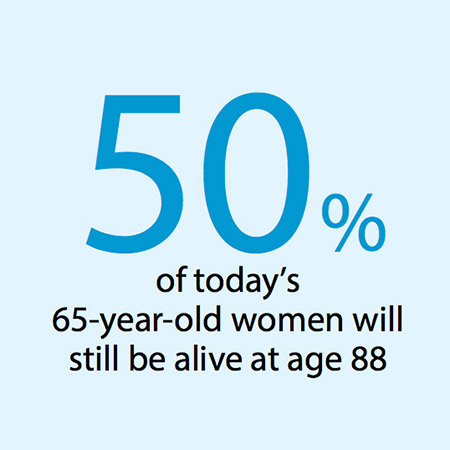

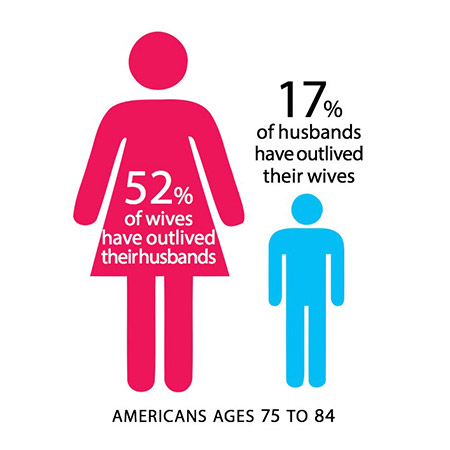

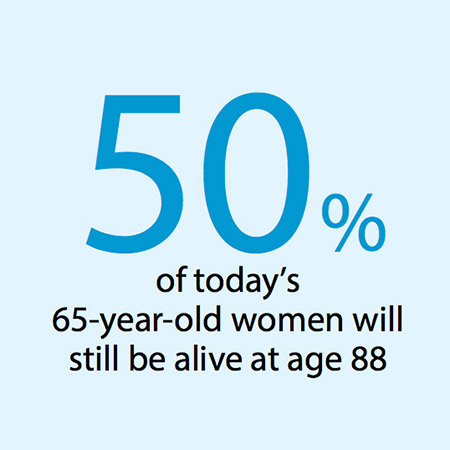

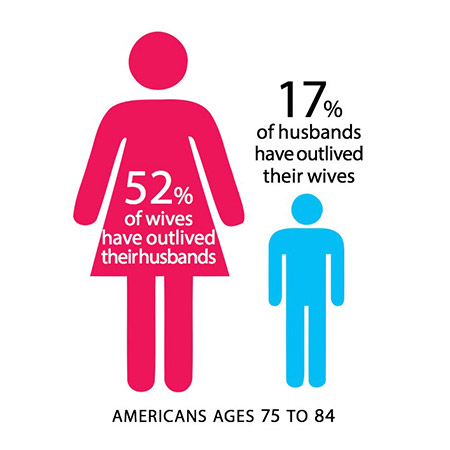

I've said it before and I'll say it again: Women, on average, live longer than men. You need your retirement money to last through your lifetime. And even if you're one-hundred-percent certain that your man is doing a perfect job planning for your well-being, you can't afford to stay in the dark. I've seen too many newly widowed women struggling to figure out their finances in the midst of grief. The time to learn is not when you're suffering a great loss. The time is now.

Social (Security) Studies

While you and your spouse are alive, each of you can claim your own Social Security benefit, but a surviving spouse is entitled to only the higher of the two benefits. How to maximize that number? Have the higher-earning spouse delay starting his or her benefit until age 70. You're eligible to begin collecting Social Security at age 62, but the longer you delay, the more your payout grows.

Paying Attention to Pensions

If you or your spouse has a pension, you have some crucial decisions to make.Option 1: With the life-only option, or single-life annuity, payments continue only as long as the retiree lives.

Option 2: With a joint and survivor annuity, payments continue as long as the surviving spouse lives.

The monthly payout in the first option will be higher than in the second. But if you're focused on income for the surviving spouse (you, more likely than not), option 2 is better. If you choose it, you'll also need to set the size of the survivor's benefit: 100 percent of what the retiree received while alive, or a lower percentage. If your goal is to maximize the survivor's income, choose 100 percent. This will decrease the monthly payout while both of you are living, but remember the goal: the survivor's well-being.

The Best Investors

In a study of the portfolio trading habits of thousands of people over six years, women, on average, outperformed men by nearly 1 percentage point a year. Men's overconfidence in their stock-picking skills led them to trade their accounts 45 percent more than women, who patiently let a buy-and-hold strategy do its work. Lesson: To avoid leaving money on the table, take a place there yourself!

Suze Orman's latest book is The Money Class: How to Stand in Your Truth and Create the Future You Deserve.

Flying Solo

I've said it before and I'll say it again: Women, on average, live longer than men. You need your retirement money to last through your lifetime. And even if you're one-hundred-percent certain that your man is doing a perfect job planning for your well-being, you can't afford to stay in the dark. I've seen too many newly widowed women struggling to figure out their finances in the midst of grief. The time to learn is not when you're suffering a great loss. The time is now.

Social (Security) Studies

While you and your spouse are alive, each of you can claim your own Social Security benefit, but a surviving spouse is entitled to only the higher of the two benefits. How to maximize that number? Have the higher-earning spouse delay starting his or her benefit until age 70. You're eligible to begin collecting Social Security at age 62, but the longer you delay, the more your payout grows.

Paying Attention to Pensions

If you or your spouse has a pension, you have some crucial decisions to make.

The monthly payout in the first option will be higher than in the second. But if you're focused on income for the surviving spouse (you, more likely than not), option 2 is better. If you choose it, you'll also need to set the size of the survivor's benefit: 100 percent of what the retiree received while alive, or a lower percentage. If your goal is to maximize the survivor's income, choose 100 percent. This will decrease the monthly payout while both of you are living, but remember the goal: the survivor's well-being.

The Best Investors

In a study of the portfolio trading habits of thousands of people over six years, women, on average, outperformed men by nearly 1 percentage point a year. Men's overconfidence in their stock-picking skills led them to trade their accounts 45 percent more than women, who patiently let a buy-and-hold strategy do its work. Lesson: To avoid leaving money on the table, take a place there yourself!

Suze Orman's latest book is The Money Class: How to Stand in Your Truth and Create the Future You Deserve.