The Widlunds' Disappointment

When Oprah met the Widlund family, they admitted that super-sized debt had sent their family into a tailspin. Mark, a satellite installation manager, and Marnie, a benefit specialist, were bringing home about $80,000 a year—but they had no retirement savings, no life insurance and no college savings for their two daughters, Victoria and Gracie. They were $81,000 in debt.

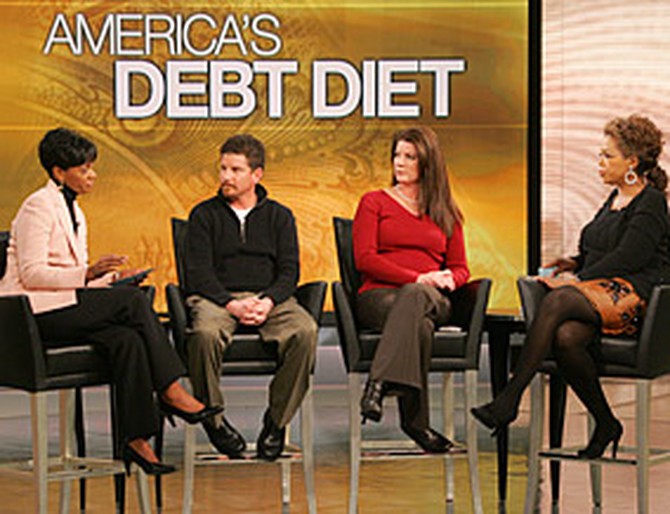

The staggering debt took a toll on Mark and Marnie, who argued constantly over bills. Money coach Glinda Bridgforth, author of Girl, Get Your Credit Straight!, offered to help the Widlunds get their spending under control and help save their marriage. "I feel that [the marriage] is going to begin to heal itself once [Marnie and Mark] start to deal with the finances," Glinda said.

At first, Marnie and Mark made progress, but their struggles were not over.

The staggering debt took a toll on Mark and Marnie, who argued constantly over bills. Money coach Glinda Bridgforth, author of Girl, Get Your Credit Straight!, offered to help the Widlunds get their spending under control and help save their marriage. "I feel that [the marriage] is going to begin to heal itself once [Marnie and Mark] start to deal with the finances," Glinda said.

At first, Marnie and Mark made progress, but their struggles were not over.

A year after the Widlunds began the Debt Diet, their debt has increased by $37,000. Marnie and Mark admit that they stopped listening to Glinda's suggestions and following the Debt Diet principles about six months into the program. Marnie even stopped speaking to their money coach entirely.

Marnie: Not on a personal level. Just the intrusiveness…

Glinda: It was totally on a personal level.

Marnie: It got so invasive and so intrusive, which obviously we needed the accountability, but it got to be to a level that…

Oprah: You didn't want to do it.

Glinda says she thinks the Widlunds were ready to get out of financial crisis, but they weren't really ready to get out of debt. Before they started the program, Marnie and Mark were behind on most of their bills, but now they're back on track. "I think that they were actually ready to take some action but didn't really realize how difficult it was going to be," Glinda says.

Although the Widlunds ended up deeper in debt, they did have a few small successes. Glinda says they refinanced their home, paid off some bills and increased their income by more than $15,000.

Marnie: Not on a personal level. Just the intrusiveness…

Glinda: It was totally on a personal level.

Marnie: It got so invasive and so intrusive, which obviously we needed the accountability, but it got to be to a level that…

Oprah: You didn't want to do it.

Glinda says she thinks the Widlunds were ready to get out of financial crisis, but they weren't really ready to get out of debt. Before they started the program, Marnie and Mark were behind on most of their bills, but now they're back on track. "I think that they were actually ready to take some action but didn't really realize how difficult it was going to be," Glinda says.

Although the Widlunds ended up deeper in debt, they did have a few small successes. Glinda says they refinanced their home, paid off some bills and increased their income by more than $15,000.

Marnie admits that if she and her husband had listened to Glinda, they might have been able to put their additional income to good use and pay off some of their debt.

"I think, too, that maybe I wasn't listening to all of the bigger goals," Marnie says. "I think we achieved the majority of my goals that I wrote down, but I wasn't seeing everything that was available to us. I'm very remorseful about that but…next year."

Once the Widlunds refinanced their home, Mark says they paid off a few bills and then lost focus. "We felt like we had done it all," he says.

Glinda says that debt starts to add up when people aren't held accountable for their financial decisions. "Everybody needs to be accountable to somebody, whether it's a coach, whether it's accountable to your partner," she says. "So because our communication broke down, there wasn't that accountability to say, 'This is what I plan to do.'"

More on money and relationships

"I think, too, that maybe I wasn't listening to all of the bigger goals," Marnie says. "I think we achieved the majority of my goals that I wrote down, but I wasn't seeing everything that was available to us. I'm very remorseful about that but…next year."

Once the Widlunds refinanced their home, Mark says they paid off a few bills and then lost focus. "We felt like we had done it all," he says.

Glinda says that debt starts to add up when people aren't held accountable for their financial decisions. "Everybody needs to be accountable to somebody, whether it's a coach, whether it's accountable to your partner," she says. "So because our communication broke down, there wasn't that accountability to say, 'This is what I plan to do.'"

More on money and relationships

Published 01/01/2006