Financial Crisis 101

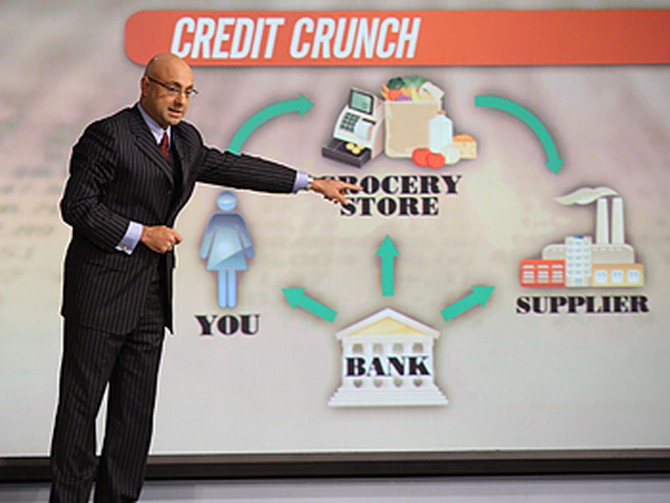

The other key to understanding the financial mess is understanding credit, Ali says. "Let's show you how central credit and banking is to your life," he says. "The bank gives you a credit card, and you use that to spend money at the grocery store. But the bank also gives the grocery store money because the grocery store has to [borrow] to buy things from a supplier, let's say the cereal factory. ...The supplier [or cereal factory] needs to buy wheat or flour, so they borrow money from the bank [too]." But because of the current economic situation, banks don't trust anyone to pay them back, Ali says. "Your credit line, if you did nothing wrong, may have been reduced by the bank just because they are scared that you might get into trouble."

Ali says that, due to credit reduction, the cereal factory can't buy as much wheat, and the grocery store can't buy as much cereal. When stores or suppliers can't afford to buy as much they used to, they can't do as much business. Then, people get laid off.

As a result, all the people who lost their jobs aren't paying taxes or shopping as much, Ali says. "They're a net drain on the financial system. They're not contributing." Ali says that in the first nine months of 2008, 750,000 people in the United States lost their jobs. In September 2008 alone, an incredible 159,000 jobs were lost. "This is what hurts this system," he says. "And that's why it affects you."

Ali says that, due to credit reduction, the cereal factory can't buy as much wheat, and the grocery store can't buy as much cereal. When stores or suppliers can't afford to buy as much they used to, they can't do as much business. Then, people get laid off.

As a result, all the people who lost their jobs aren't paying taxes or shopping as much, Ali says. "They're a net drain on the financial system. They're not contributing." Ali says that in the first nine months of 2008, 750,000 people in the United States lost their jobs. In September 2008 alone, an incredible 159,000 jobs were lost. "This is what hurts this system," he says. "And that's why it affects you."

Published 10/03/2008