Suze's Money Smackdowns

There's one in every family—what do you do about the relative who's always asking for money and draining you dry? Meet a family who has reached its breaking point.

Nicole is a 33-year-old chemical engineer who makes a great living. But even though she earns $80,000 a year, Nicole says she's living paycheck to paycheck. "What has really kept me from saving and doing the things that I know I need to do with my money is my sister," Nicole says.

Nicole owns the house her sister Kelly lives in, but has a hard time making the mortgage payment because Kelly is often late with her rent. "If she's late, I allow her to be late on the rent. But the mortgage company doesn't allow me to be late on my mortgage," Nicole says. "So I have to save that money from my tax refund to kind of hedge it out so that when she is late, I still have money in the bank to pay the mortgage on time because I have to preserve my credit."

Nicole and Kelly's mother, Cynthia, says Kelly is always late on her bills. "Everything is always cut off. Her lights...her water...gas," Cynthia says. "Let's not talk about car payments."

It's gotten to the point where Nicole doesn't have any wiggle room in her own budget. "I can't misstep an inch off of my finances because she'll throw a monkey wrench in everything with one phone call—'I need $300 or they'll take my car. I need $500 or they'll kick me out of my house,'" Nicole says.

Nicole is a 33-year-old chemical engineer who makes a great living. But even though she earns $80,000 a year, Nicole says she's living paycheck to paycheck. "What has really kept me from saving and doing the things that I know I need to do with my money is my sister," Nicole says.

Nicole owns the house her sister Kelly lives in, but has a hard time making the mortgage payment because Kelly is often late with her rent. "If she's late, I allow her to be late on the rent. But the mortgage company doesn't allow me to be late on my mortgage," Nicole says. "So I have to save that money from my tax refund to kind of hedge it out so that when she is late, I still have money in the bank to pay the mortgage on time because I have to preserve my credit."

Nicole and Kelly's mother, Cynthia, says Kelly is always late on her bills. "Everything is always cut off. Her lights...her water...gas," Cynthia says. "Let's not talk about car payments."

It's gotten to the point where Nicole doesn't have any wiggle room in her own budget. "I can't misstep an inch off of my finances because she'll throw a monkey wrench in everything with one phone call—'I need $300 or they'll take my car. I need $500 or they'll kick me out of my house,'" Nicole says.

Kelly's constant borrowing is taking an emotional toll on Nicole. "I sit down with her a lot and I try to help her figure things out. Try to teach her about budgeting. Teach her about credit," Nicole says. "But it seems like when she doesn't get it and she does what she wants to do, she comes to me, and it hurts because it feels like I'm not doing what I need to do to help her grow."

Nicole says she also feels responsible for her sister. "We come from a family who believes if one has, everyone should have—even if the other person is not sustaining and being consistent with their finances," Nicole says.

At the end of the day, Nicole and Cynthia say Kelly will continue to get what she wants because they won't say no. "I give her money because my grandkids live with her, and that is always what gets to me," Cynthia says.

Nicole admits Kelly is becoming a burden. "Kelly is really bleeding my mother and I dry," Nicole says. "Every time that I look at her it's like, 'What are you doing to me?' I think about that sometimes, and it's hard because I love her. I wish she would stop hurting me."

Nicole says she also feels responsible for her sister. "We come from a family who believes if one has, everyone should have—even if the other person is not sustaining and being consistent with their finances," Nicole says.

At the end of the day, Nicole and Cynthia say Kelly will continue to get what she wants because they won't say no. "I give her money because my grandkids live with her, and that is always what gets to me," Cynthia says.

Nicole admits Kelly is becoming a burden. "Kelly is really bleeding my mother and I dry," Nicole says. "Every time that I look at her it's like, 'What are you doing to me?' I think about that sometimes, and it's hard because I love her. I wish she would stop hurting me."

It's time for a money intervention with Kelly, so financial expert Suze Orman visits the family for a "Suze smackdown." But before Suze arrives, Kelly drops by Nicole's house unexpectedly, catching everyone by surprise.

"Kelly, we've got someone coming in to help us all understand what's going on and the issues we're having, so we're just trying to get some help for our family," Nicole says. "This is going to be a good thing. I think if we just open our hearts, open our minds, and know this all comes from love, because you know we love you, Kelly."

Kelly says she's ready for help. "I know I depend on my sister and mom a lot, and I know it can be a heavy burden on them," Kelly says. "I'm nervous ... I just know I need some guidance, direction. I don't want to have to always rely on my sister or my mom."

Follow these guidelines if you need to stage your own money intervention.

Suze arrives with some tough love. "It is so obvious that the three of you love each other," Suze says. "But what if I told you that these acts of supposed love are not only destroying her life, but your grandchildren's life? Would you still want to do it?"

When it comes to money, Suze says too many people say yes to their loved ones out of fear. "Fear that she won't love you, fear that the grandkids won't love you. Fear that your daughter won't love you," Suze says. "Today we are going to learn how to say no out of love."

"Kelly, we've got someone coming in to help us all understand what's going on and the issues we're having, so we're just trying to get some help for our family," Nicole says. "This is going to be a good thing. I think if we just open our hearts, open our minds, and know this all comes from love, because you know we love you, Kelly."

Kelly says she's ready for help. "I know I depend on my sister and mom a lot, and I know it can be a heavy burden on them," Kelly says. "I'm nervous ... I just know I need some guidance, direction. I don't want to have to always rely on my sister or my mom."

Follow these guidelines if you need to stage your own money intervention.

Suze arrives with some tough love. "It is so obvious that the three of you love each other," Suze says. "But what if I told you that these acts of supposed love are not only destroying her life, but your grandchildren's life? Would you still want to do it?"

When it comes to money, Suze says too many people say yes to their loved ones out of fear. "Fear that she won't love you, fear that the grandkids won't love you. Fear that your daughter won't love you," Suze says. "Today we are going to learn how to say no out of love."

Suze wants to know what Nicole and Cynthia think Kelly would do if for some reason they were out of her life. "I have no earthly clue, and that's what I worry about," Nicole says. "I think I delude myself in thinking Kelly's going to get it, you know, if I continue to give through this period. This one more time, then next time she'll get it."

As a result of what they have given to Kelly, neither Nicole nor Cynthia have emergency savings and Nicole has $20,000 in credit card debt. Suze has a hard truth for Nicole and Cynthia to accept: They, in fact, are the ones to blame for Kelly's money problems.

"When you fix a problem with money, you aren't fixing anything. You are keeping it broken. So because they were saying yes, because it was easier to say yes than to do what was right, which was to say no, [Kelly] would never get to understand who she was," Suze says. "What are they really sharing? They are sharing poverty. They are sharing lies. They are sharing powerlessness. They aren't sharing the money. ... They share what Kelly has—nothing."

But Kelly isn't off the hook. "Every time that you spend money that you don't have, you're lying," Suze says. "Every time you don't pay your sister the rent, you are lying. Every time you avoid your car payment, you are lying. Every time you don't do something that's responsible with money, you are lying. And you are lying because you aren't living the truth with who you are. So stop it and stop it right now! Let's start turning our lives around right now."

To start, Suze has Kelly, Nicole and Cynthia sign a contract stating that Kelly will no longer rely on her family for loans.

Download a sample contract to use if you're in a similar situation.

"When they say no to you [Kelly], you are to go back and read this letter," Suze says.

As a result of what they have given to Kelly, neither Nicole nor Cynthia have emergency savings and Nicole has $20,000 in credit card debt. Suze has a hard truth for Nicole and Cynthia to accept: They, in fact, are the ones to blame for Kelly's money problems.

"When you fix a problem with money, you aren't fixing anything. You are keeping it broken. So because they were saying yes, because it was easier to say yes than to do what was right, which was to say no, [Kelly] would never get to understand who she was," Suze says. "What are they really sharing? They are sharing poverty. They are sharing lies. They are sharing powerlessness. They aren't sharing the money. ... They share what Kelly has—nothing."

But Kelly isn't off the hook. "Every time that you spend money that you don't have, you're lying," Suze says. "Every time you don't pay your sister the rent, you are lying. Every time you avoid your car payment, you are lying. Every time you don't do something that's responsible with money, you are lying. And you are lying because you aren't living the truth with who you are. So stop it and stop it right now! Let's start turning our lives around right now."

To start, Suze has Kelly, Nicole and Cynthia sign a contract stating that Kelly will no longer rely on her family for loans.

Download a sample contract to use if you're in a similar situation.

"When they say no to you [Kelly], you are to go back and read this letter," Suze says.

Before Kelly can start saving, Suze says she needs to face the truth about her financial situation. To show her how bad things have become, Suze calculates Kelly's credit score—also known as a FICO score—on the website myfico.com. This important three-digit number, which ranges from about 300 to more than 850, is the numerical representation of the information in a credit report.

"[Your FICO score] determines the interest rates on your credit cards," Suze says. "It's starting to determine if an employer will hire you, if a landlord will rent to you. ... It determines everything in your life."

When Suze enters Kelly's information into the system, the damage she's done to her credit is revealed almost instantly. Her Equifax score, 449, falls in the "bad" range, as does her TransUnion score (536) and Experian score (545).

How to repair damaged credit

Looking back, Kelly says she wasn't surprised by the low numbers, but confronting the truth took an emotional toll. "At that point in my life, I was very low," she says. "I knew I needed the help."

Suze says money isn't Kelly's problem—it's merely a symbol of what's going wrong in her life. "Money is the currency of life. It's a physical manifestation of who you are," she says. "If there's trouble with money, it's never the money. ... The bigger issue is you. That's why I've always said self-worth equals net worth. When I see low FICO scores, I see debt, I see somebody late in payments, I know they don't like who they are."

"[Your FICO score] determines the interest rates on your credit cards," Suze says. "It's starting to determine if an employer will hire you, if a landlord will rent to you. ... It determines everything in your life."

When Suze enters Kelly's information into the system, the damage she's done to her credit is revealed almost instantly. Her Equifax score, 449, falls in the "bad" range, as does her TransUnion score (536) and Experian score (545).

How to repair damaged credit

Looking back, Kelly says she wasn't surprised by the low numbers, but confronting the truth took an emotional toll. "At that point in my life, I was very low," she says. "I knew I needed the help."

Suze says money isn't Kelly's problem—it's merely a symbol of what's going wrong in her life. "Money is the currency of life. It's a physical manifestation of who you are," she says. "If there's trouble with money, it's never the money. ... The bigger issue is you. That's why I've always said self-worth equals net worth. When I see low FICO scores, I see debt, I see somebody late in payments, I know they don't like who they are."

Suze pays a visit to Kelly's house to see what she's spending her money on. After stepping through the front door, the first thing she notices is Kelly's big-screen television.

"Right here is your one month's rent to your sister," Suze says. "Can you imagine how that makes [your sister] feel every time she walks in here?"

While touring the rest of the house, Suze says she isn't surprised to find every room in utter chaos. "When you can't respect what money can buy, you can't respect money—period," Suze says. "When somebody lives in such chaos, your inner soul is chaotic. Somebody who is at one with their inner self doesn't feel good when things are chaotic around them."

Kelly says her messy house makes her feel bad about herself. "I wasn't raised to live like this," she says. "When I come into my home, it should be a place of peace, but it's not for me."

In the basement, Suze stumbles upon a purchase that Nicole says broke her heart—a $1,000 treadmill that represents yet another missed rent payment.

Prior to Suze's intervention, Kelly says she didn't realize she was hurting her sister. "I was in the storm," she says. "When Suze came and kind of used the metaphors of, 'Look at your dishes. This is a sign of your life being chaotic.' I didn't look at any of that that way. ... That let me know that I didn't have respect for myself. ... I realized at that moment how I disrespect my sister and my mom."

"Right here is your one month's rent to your sister," Suze says. "Can you imagine how that makes [your sister] feel every time she walks in here?"

While touring the rest of the house, Suze says she isn't surprised to find every room in utter chaos. "When you can't respect what money can buy, you can't respect money—period," Suze says. "When somebody lives in such chaos, your inner soul is chaotic. Somebody who is at one with their inner self doesn't feel good when things are chaotic around them."

Kelly says her messy house makes her feel bad about herself. "I wasn't raised to live like this," she says. "When I come into my home, it should be a place of peace, but it's not for me."

In the basement, Suze stumbles upon a purchase that Nicole says broke her heart—a $1,000 treadmill that represents yet another missed rent payment.

Prior to Suze's intervention, Kelly says she didn't realize she was hurting her sister. "I was in the storm," she says. "When Suze came and kind of used the metaphors of, 'Look at your dishes. This is a sign of your life being chaotic.' I didn't look at any of that that way. ... That let me know that I didn't have respect for myself. ... I realized at that moment how I disrespect my sister and my mom."

Kelly says she's felt terrible for years about turning to her mom and sister for financial help, but she knew they'd never let her go without. Even when she promised to pay back loans, Kelly admits she never had enough money to stay true to her word.

"Now that I look at it, [I felt like a liar] because I didn't follow through with what I said I was going to do," she says. "I think it became habit. It's like a bank—if you know you've got the money there, you can just go get it out with no questions asked."

Now that the bank is closed, it's time to make some tough decisions. Nicole says she's decided to sell her house and the house Kelly's living in. Then, she's planning to move to Texas. Before she leaves, she offers to help Kelly find a new apartment and pay the first and last month's rent.

"I'm going to set you free," she says to Kelly. "I'm sorry for burdening you with the help that I've provided this far, but I think you can do it. I think you have it in you to be free and powerful and the beautiful woman you are."

Kelly is now determined to make it on her own. "I can admit that I was wrong for all these years I've been relying on you and relying on Mom to help me try to make it in life," she tells Nicole. "I'm so sorry I disrespected you. I thank you, and I love you. ... I feel so victorious. I feel so much joy and peace."

"Now that I look at it, [I felt like a liar] because I didn't follow through with what I said I was going to do," she says. "I think it became habit. It's like a bank—if you know you've got the money there, you can just go get it out with no questions asked."

Now that the bank is closed, it's time to make some tough decisions. Nicole says she's decided to sell her house and the house Kelly's living in. Then, she's planning to move to Texas. Before she leaves, she offers to help Kelly find a new apartment and pay the first and last month's rent.

"I'm going to set you free," she says to Kelly. "I'm sorry for burdening you with the help that I've provided this far, but I think you can do it. I think you have it in you to be free and powerful and the beautiful woman you are."

Kelly is now determined to make it on her own. "I can admit that I was wrong for all these years I've been relying on you and relying on Mom to help me try to make it in life," she tells Nicole. "I'm so sorry I disrespected you. I thank you, and I love you. ... I feel so victorious. I feel so much joy and peace."

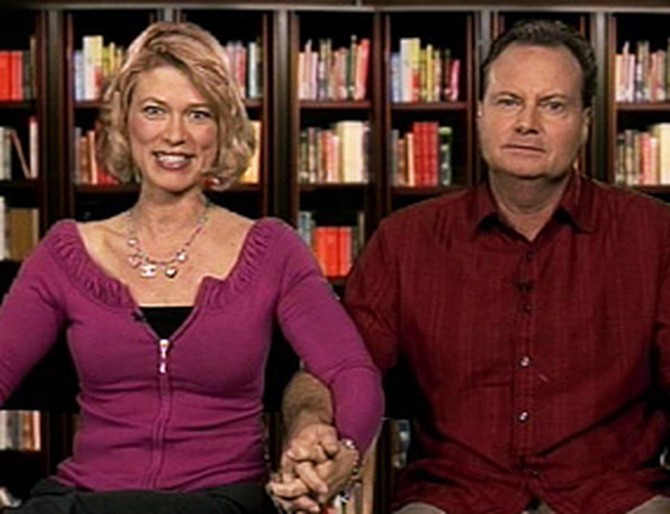

Fighting about money is the number one cause of divorce in the United States. From the outside, it looks as if Greer and her husband, David, have a great life—a nice house, good jobs and a good marriage. In reality, Greer and David are dangerously close to divorce.

Greer and David purchased a house in October 2006 before they sold their old one. They also purchased two new cars in March 2007. "When we moved into the house, we spent $5,000 alone on the countertops. We spent $4,000 on the fence and another $2,000 on the kitchen table and chairs," Greer says. Altogether, David estimates they have funneled about $20,000 into the house.

But their spending doesn't stop at the house. David says he's put about $1,000 into his golf clubs—and bought $100 golf clubs for his 4-year-old daughter. "His spending habits are out of control," Greer says.

For Christmas, Greer received a Nintendo Wii video game system. "I love my wife. I do. I love my kids," David says. "I look at the $200 or $250 that I spent on that, you know, to be able to have quality time with them? It's just priceless."

David estimates they are $20,000–$30,000 in debt. When Suze reviews their finances, she finds they are spending $6,000 more than what they have each month. "Every month when I open the bills, I'm always worried about what am I going to be able to pay now or what am I going to be able to float to the next month," Greer says.

Greer and David purchased a house in October 2006 before they sold their old one. They also purchased two new cars in March 2007. "When we moved into the house, we spent $5,000 alone on the countertops. We spent $4,000 on the fence and another $2,000 on the kitchen table and chairs," Greer says. Altogether, David estimates they have funneled about $20,000 into the house.

But their spending doesn't stop at the house. David says he's put about $1,000 into his golf clubs—and bought $100 golf clubs for his 4-year-old daughter. "His spending habits are out of control," Greer says.

For Christmas, Greer received a Nintendo Wii video game system. "I love my wife. I do. I love my kids," David says. "I look at the $200 or $250 that I spent on that, you know, to be able to have quality time with them? It's just priceless."

David estimates they are $20,000–$30,000 in debt. When Suze reviews their finances, she finds they are spending $6,000 more than what they have each month. "Every month when I open the bills, I'm always worried about what am I going to be able to pay now or what am I going to be able to float to the next month," Greer says.

Financial problems aren't only taking a toll on Greer and David's marriage—they're affecting their health. "I guess I could say I'm on a roller coaster," he says. "I have got on an antidepressant medication because of it. Our financials have created a lot of tension between us."

Greer says she feels like she's falling apart. "I relieve my stress by eating, unfortunately. I've put on a lot of weight," she says. "I've absolutely lost myself. I've just become this person who's on autopilot."

The severity of their situation has finally hit home. "I think I'm one foot out the door for a divorce," Greer says. "I don't see how we can stay together anymore in this situation. I don't think it would be good for him, and I don't think it would be good for me. I'm willing to make any sacrifice at all."

David says something needs to change soon, or they will lose everything. "We're going to lose our marriage. We're going to lose our home. It's all going to be gone. It hurts to think that, because of the financial positions that we are [in], I'm going to run the risk of losing my kids," he says. "For the first time, you know, we're going to raise up the white flag and ask for help."

Greer says she feels like she's falling apart. "I relieve my stress by eating, unfortunately. I've put on a lot of weight," she says. "I've absolutely lost myself. I've just become this person who's on autopilot."

The severity of their situation has finally hit home. "I think I'm one foot out the door for a divorce," Greer says. "I don't see how we can stay together anymore in this situation. I don't think it would be good for him, and I don't think it would be good for me. I'm willing to make any sacrifice at all."

David says something needs to change soon, or they will lose everything. "We're going to lose our marriage. We're going to lose our home. It's all going to be gone. It hurts to think that, because of the financial positions that we are [in], I'm going to run the risk of losing my kids," he says. "For the first time, you know, we're going to raise up the white flag and ask for help."

Before tackling David and Greer's debt, Suze shifts focus to something more important—their relationship. She asks them to write down five things that aren't working in their marriage. After looking them over, they realize their lists are almost identical.

Money isn't their main problem, after all. "The number one thing that they're really asking for is communication with each other and more time alone," Suze says. "Here's what breaks my heart about this—[Greer is] ready to go out the door. [She's] known this man for 16 years. They have two children. ... And because of money, you're going to get divorced? It's not the money. It's never been the money. It's how you relate to each other, how you talk to one another."

To save their marriage, Suze says David and Greer need to start thinking like a couple. "How do you expect to be together when everything except what you buy is separate?" she asks. "They have two cars. They have two dogs. They have two houses. ... They have two of everything. You're not one with each other. That's the problem, and it's coming out in your money and, therefore, your marriage."

Greer says she's willing to do anything to keep her family together. "It is time that we come together," she says. "I want to do it for myself. I want to do it for [David] and, most importantly, I want to do it for our kids."

Money isn't their main problem, after all. "The number one thing that they're really asking for is communication with each other and more time alone," Suze says. "Here's what breaks my heart about this—[Greer is] ready to go out the door. [She's] known this man for 16 years. They have two children. ... And because of money, you're going to get divorced? It's not the money. It's never been the money. It's how you relate to each other, how you talk to one another."

To save their marriage, Suze says David and Greer need to start thinking like a couple. "How do you expect to be together when everything except what you buy is separate?" she asks. "They have two cars. They have two dogs. They have two houses. ... They have two of everything. You're not one with each other. That's the problem, and it's coming out in your money and, therefore, your marriage."

Greer says she's willing to do anything to keep her family together. "It is time that we come together," she says. "I want to do it for myself. I want to do it for [David] and, most importantly, I want to do it for our kids."

When she does begin to analyze Greer and David's money, Suze says the problem isn't their FICO score, which is good. It's their crushing debt. At the current pace, Greer and David spend about $6,000 a month more than they earn. But surely they could get that under control, right?

"Even if you sell the big house that you have right now and move back to the old house, and you keep everything, you're $3,000 a month over," Suze says. "Even if you get rid of your cars and you do everything else, you're still $1,500 a month over what you're bringing in. And now we have a problem that in a possible two months one of your renters may give up, and then we're going to be $1,500 more than that."

"I look at your money, and you are a total financial mess," Suze says.

Suze's prescription is tough. "You almost have to sell everything," she says. "Everything has to go." Suze says they must get rid of their houses and cars and move into a two-bedroom apartment and buy a more modest car.

Rather than look at their financial dire straits as a slap in the face, Suze says Greer and David must treat it as an opportunity. "Everything is a gift if you're simply willing to look at it that way," she says. "Everything, in my opinion, is a gift from God if you're just willing to unwrap it."

"Even if you sell the big house that you have right now and move back to the old house, and you keep everything, you're $3,000 a month over," Suze says. "Even if you get rid of your cars and you do everything else, you're still $1,500 a month over what you're bringing in. And now we have a problem that in a possible two months one of your renters may give up, and then we're going to be $1,500 more than that."

"I look at your money, and you are a total financial mess," Suze says.

Suze's prescription is tough. "You almost have to sell everything," she says. "Everything has to go." Suze says they must get rid of their houses and cars and move into a two-bedroom apartment and buy a more modest car.

Rather than look at their financial dire straits as a slap in the face, Suze says Greer and David must treat it as an opportunity. "Everything is a gift if you're simply willing to look at it that way," she says. "Everything, in my opinion, is a gift from God if you're just willing to unwrap it."

In October 2007, Suze confronted Phil and Felice, a married couple and parents of six children, whose finances were in ruins. Phil and Felice also had no life or health insurance for their children—despite a history of serious health problems.

Suze's financial prescription for Phil and Felice was severe. "You have to sell the house," Suze says. "You're going to have to take drastic measures. And you know when you're going to have to take them? When you go home tonight."

During a tense plane ride home, Felice says she took Suze's plan to heart. They've purchased health and life insurance, put their house on the market and sold one of their cars. "They are on the track to recovery," Suze says. "I know a lot of you didn't think they were going to do it."

In fact, Phil and Felice have changed their attitudes about money so dramatically that they have a new way to pay for their morning Starbucks. "They both go on weekends, they look for cans," Suze says. "And whatever cans they get and money they make, that money is what they can go and buy Starbucks with. But that's it."

Suze's financial prescription for Phil and Felice was severe. "You have to sell the house," Suze says. "You're going to have to take drastic measures. And you know when you're going to have to take them? When you go home tonight."

During a tense plane ride home, Felice says she took Suze's plan to heart. They've purchased health and life insurance, put their house on the market and sold one of their cars. "They are on the track to recovery," Suze says. "I know a lot of you didn't think they were going to do it."

In fact, Phil and Felice have changed their attitudes about money so dramatically that they have a new way to pay for their morning Starbucks. "They both go on weekends, they look for cans," Suze says. "And whatever cans they get and money they make, that money is what they can go and buy Starbucks with. But that's it."

Phil and Felice say Suze's plan to rein in their finances has had the added benefit of reorganizing their lives to focus on what truly matters. "I [had] put myself first, that's my biggest regret," Felice says. "And I've changed that—my kids are number one."

"If your mind's focused on materialism and self-beautification, believe me, the regret will set in," Phil says. "And especially after you look at your debt after you spend all that stuff, that promise to satisfy you doesn't satisfy anymore. Just a deep regret sets in. Focus on relationships is what is important."

There's one more piece of Suze's plan that Felice is ready to finish. "I filled out an application for Starbucks!" she says. "I'll bring that this week."

Phil and Felice thank Suze for her advice...and for finally getting the truth through. "She gave me a good kick in the butt, that's what she did," Felice says.

Read an excerpt from Suze's book, Women & Money: Owning the Power to Control Your Destiny.

"If your mind's focused on materialism and self-beautification, believe me, the regret will set in," Phil says. "And especially after you look at your debt after you spend all that stuff, that promise to satisfy you doesn't satisfy anymore. Just a deep regret sets in. Focus on relationships is what is important."

There's one more piece of Suze's plan that Felice is ready to finish. "I filled out an application for Starbucks!" she says. "I'll bring that this week."

Phil and Felice thank Suze for her advice...and for finally getting the truth through. "She gave me a good kick in the butt, that's what she did," Felice says.

Read an excerpt from Suze's book, Women & Money: Owning the Power to Control Your Destiny.

Published 03/14/2008